Key Highlights

- USD/JPY started a fresh increase above the 134.00 resistance.

- It cleared a major bearish trend line at 134.10 on the 4-hours chart.

- EUR/USD is struggling below the 1.0200 resistance zone.

- GBP/USD extended decline and spiked below the 1.2020 level.

USD/JPY Technical Analysis

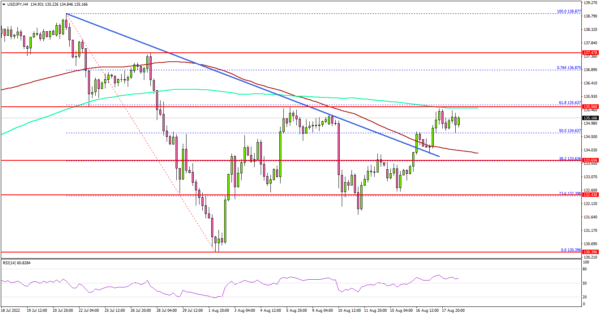

The US Dollar formed a base above the 131.50 level and started a fresh increase against the Japanese Yen. USD/JPY broke the 133.20 and 133.50 resistance levels to move into a positive zone.

Looking at the 4-hours chart, the pair was able to settle above the 134.00 resistance and the 100 simple moving average (red, 4-hours). There was also a break above a major bearish trend line at 134.10.

The pair surpassed the 50% Fib retracement level of the downward move from the 138.87 swing high to 130.39 low. It is now showing positive signs above the 134.50 level. On the upside, the pair is facing resistance near the 135.65 level and the 200 simple moving average (green, 4-hours).

The next major resistance is near the 136.85 level. It is near the 76.4% Fib retracement level of the downward move from the 138.87 swing high to 130.39 low.

A clear move above the 136.85 resistance might send the pair higher towards the 138.00 level. The next major resistance is 138.80, above which the pair could accelerate higher. In the stated case, the pair could rise towards the 139.50 resistance zone in the near term.

On the downside, there is a decent support forming near 134.50 level. The main support is now forming near the 134.00 level. A downside break below the 134.00 support might push the pair in a negative zone.

Looking at EUR/USD, the pair remained in a bearish zone below the 1.0200 level and might extend losses in the near term.

Economic Releases

- UK Retail Sales for July 2022 (YoY) – Forecast -3.3%, versus -5.8% previous.

- UK Retail Sales for July 2022 (MoM) – Forecast -0.2%, versus -0.1% previous.

- Canadian Retail Sales for June 2022 (MoM) – Forecast +0.3%, versus +2.2% previous.

- Canadian Retail Sales ex Autos for June 2022 (MoM) – Forecast +0.9%, versus +1.9% previous.