EUR/USD

During yesterday’s trading session, the single European currency managed to register some growth and to overcome the nearest resistance at 1.0158. At the time of writing, neither the bears nor the bulls are able to prevail and move away from the level at 1.0158. This is likely to remain the case until 12:30 GMT, when the retail price index and the business investment index data will be released. Another major news that could cause high volatility is that of crude oil stocks at 14:30 GMT. If the news is positive for the bulls, then they could make an attempt to reach the next resistance at 1.0276.

USD/JPY

During yesterday’s trading session for the Ninja, the bulls managed to consolidate the resistance breach at 133.29 and to reach and test the next one at 134.33. Their breach is still not confirmed, and at the time of writing, the levels are moving around the mentioned resistance. If investors maintain their momentum, then the next resistance for them would be the level at 135.38.

GBP/USD

The sterling’s situation is similar to that of the USD/JPY, with the bulls managing to gain the upper hand. During yesterday’s trading session, they managed to breach the resistance at 1.2063, but made an unsuccessful attempt to breach the next one at 1.2134. From the end of yesterday’s session right up until now, we have been observing the so-called “sideways movement”. If, however, the bulls manage to overcome the resistance at 1.2134, then they would have to face the next one at 1.2183 as well. On the other hand, if the bears manage to recover yesterday’s losses, then they could test the support at 1.2020.

EUGERMANY40

The bullish trend seems to have prevailed in the German index as well. During yesterday’s trading session, investors managed to consolidate the resistance breach at 13.884. The next psychological resistance – the level of 14000 – can be seen from the higher time frames. If the bulls lose their ground and the bears regain their lost positions, then the latter could test the support at 13785.

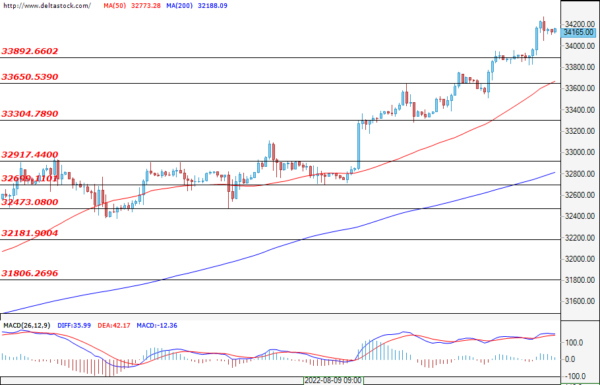

US30

The bulls are reigning supreme in the U.S. blue-chip market as well. So far, they managed to breach the key resistance at 33900 and are now heading for the next one at 34300. If the bears manage to turn around and show their teeth, then a successful recovery of their losses could result in a test of the support at 33650.