EUR/USD

On Thursday this week, the single European currency was moving erratically. The day started low, but at the European open, the bulls took control and reached the same price as Wednesday, namely 1.0364. The reaction of the bears after the release of the U.S. manufacturing inflation data was swift and they brought the currency down from its double top and so the market closed at around 1.0317. Today, between 6:45 and 09:00 GMT, we will see a set of data that may give the euro a clear direction. Whether Tuesday’s move will be further corrected or if we see a new wave of uptrend movements will depend on traders’ reaction to today’s data.

USD/JPY

The Ninja is still hesitant about which direction to take after several extremely volatile trading sessions. In the early hours, we saw attempts to breach the key 133.27 level, but the bulls gave up, and in the next few hours, we saw a bottom deeper than the one reached yesterday. The price of 131.70 played the role of support and the USD/JPY managed to end the day with a bounce of nearly 30 pips from the mentioned bottom. Today, the data at 14:00 GMT on the current state of consumer sentiment in the U.S. may have an effect on the currency pair. Whether the corrections will deepen or if we will see a reversal of the trend remains to be seen.

GBP/USD

Yesterday, the Cable’s situation was akin to that of the euro. It started low, followed by a bull attack, but after reaching the 1.2243 resistance, the pair began moving in a narrow 40-pip range. We saw some slight buying at the 1.2183 levels, but everyone seems to be holding their breath as they await today’s data releases. At 6:00 GMT, we’ll gain more insights into the UK gross domestic product on a monthly basis, as well as the preliminary count of quarterly GDP. Along with this, we also expect a report showing whether the production slowdown is continuing or deepening. If the results are negative, then the probability of the GBP/USD going down would be high because of the political crisis on the island and the lack of clarity about who will take over the role of Boris Johnson.

EUGERMANY40

Yesterday, with the opening of the European session, we saw a failed second attempt to breach last week’s level of 13795. This, of course, denied the bulls a follow-up attack, and by the end of the day, the German index was under the firm grasp of the bears and headed back to the key prices at around 13630, where the day ended. Whether the EUGERMANY40 will be able to secure a new monthly high will depend on whether we will see a successful breakout of the abovementioned level. A deepening of the correction should not be ruled out as well because of the still ongoing energy crisis in the EU.

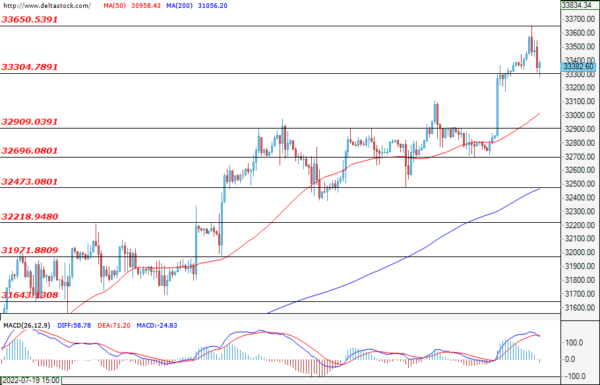

US30

In the European session, the blue-chip index moved in a convincing uptrend and managed to reach a new monthly and weekly high of 33650. When Wall Street opened at 13:30 GMT, the bears found a good entry point at this price and took control of the index by the end of the day. They managed to get it back to 33300, where the index found support. Given the weakening of the dollar this week, it is fully expected to see an increase in the U.S. indices’ prices. The likelihood of this trend continuing will depend on the reaction to the current state of the U.S. consumer sentiment for the month of July due today at 14:00 GMT.