Key Highlights

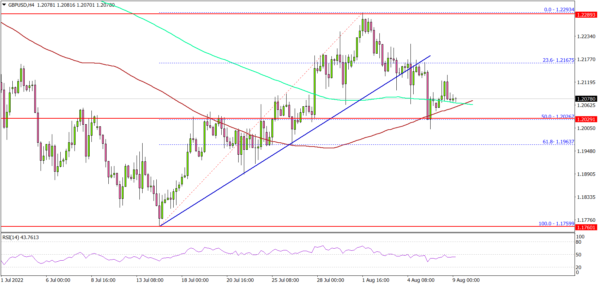

- GBP/USD struggled near 1.2290 and corrected lower.

- It broke a key bullish trend line with support near 1.2160 on the 4-hours chart.

- Gold price is showing positive signs and eyes more upsides.

- EUR/USD is consolidating near the 1.0200 level.

GBP/USD Technical Analysis

The British Pound attempted an upside break above the 1.2300 resistance against the US Dollar. GBP/USD failed to continue higher and formed a short-term top near 1.2293.

Looking at the 4-hours chart, the pair started a downside correction below the 1.2250 support level. There was a move below a key bullish trend line with support near 1.2160. The pair dipped below the 23.6% Fib retracement level of the upward move from the 1.1759 swing low to 1.2293 high.

It even spiked lower to test the 1.2000 level. It is now consolidating near the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The first major support is near the 1.2025 level. It is near the 50% Fib retracement level of the upward move from the 1.1759 swing low to 1.2293 high. A downside break below the 1.2000 support might spark more losses.

The next major support is near 1.1920. Any more losses might send the pair towards the 1.1850 zone. On the upside, the pair is facing resistance near the 1.2100 level.

The next major resistance is near the 1.2160 level, above which the pair could accelerate higher. In the stated case, the pair could rise towards the 1.2300 resistance zone in the near term.

Looking at gold price, there was a steady increase above the $1,780 level and seems like the bulls are eyeing more gains above the $1,800 resistance.

Economic Releases

- IBD/TIPP Economic Optimism Index for July 2022 – Forecast 36.55, versus 38.5 previous.