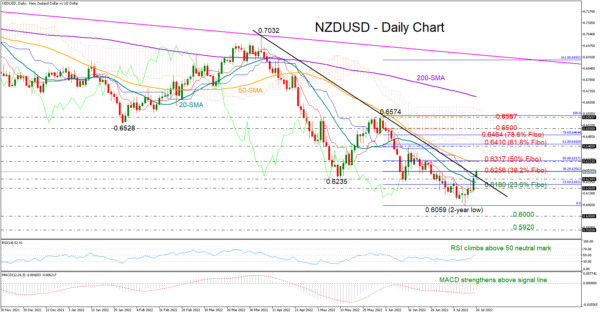

NZDUSD saw its fortune improving in the short-term picture following the clear close above the 20-day simple moving average (SMA) on Tuesday, with the focus now being on the 0.6256 resistance.

Encouragingly, the price has gained extra impetus today to climb above the descending trendline drawn from the 0.7032 peak. The technical oscillators are also mirroring increasing buying appetite as the RSI is strengthening its positive momentum above its 50 neutral mark and the MACD is distancing itself above its red signal line.

If buyers preserve strength above the descending trendline and the 0.6256 bar, which is the 38.2% Fibonacci retracement of the latest downleg, the next obstacle could pop up around the 50-day simple moving average (SMA) and the 50% Fibonacci of 0.6317. Further up, the recovery may pick up steam towards the 0.6400 round level and the 61.8% Fibonacci, while a sustained move past the 78.6% Fibonacci of 0.6564 and the 0.6500 mark could put the downward trajectory at risk near June’s top of 0.6567.

On the downside, a quick reference for support could be the 20-day SMA and the 23.6% Fibonacci of 0.6181, where the constraining red Tenkan-sen line is also converging. If that area cannot buffer selling tendencies, all eyes will turn to the two-year low of 0.6059. Even lower, the price may test the 0.6000 psychological number ahead of the key 0.5916 floor from April- May 2020.

In brief, NZDUSD is expected to extend its recovery in the short-term if the 0.6256 resistance gives way. The next obstacle could pop up around the 50-day SMA at 0.6317.