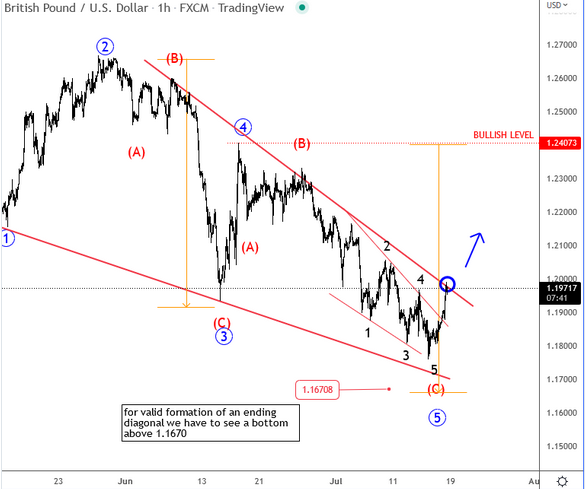

Cable is making a nice reversal from the low; it s a sharp and interesting bullish price action for now that can cause more upside this week. Keep in mind that we are tracking an ending diagonal which is normally a very powerful reversal pattern. A daily close above 1.2 can make a room for 1.24, but after intraday pullbacks. Count remains valid as long as the market trades above 1.1670 lv. Below that level wave three would be the shortest, so in such case our count should be adjusted.

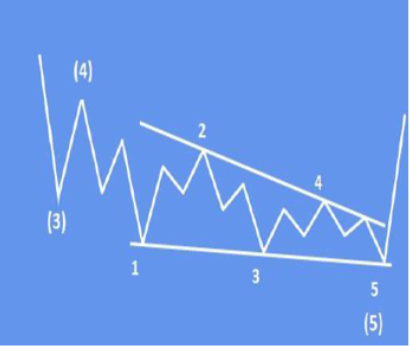

What is an ending diagonal?

I’ts a special reversal type of the pattern labeled with waves 1-2-3-4-5, where each leg is made by three subwaves. Normally it will occurs in a fifth wave but we can also find it in wave C or sometimes in wave Y of a complex correction. So, it means they occur in very late stages of a higher degree trends, and normally the price action will be slow, choppy and overlapping with a very low volume and momentum. But after market clears some stops with minor highs/lows within waves 3 and waves 5, the market will normaly make a sharp and explosive turn in the opposite dirrection. A confirmaiton point for a change in trend is when wave 2-4 line is broken, plus a closing price beyond wave 4 termination level. When diagonal is completed you can expect price to retrace back to teh starting point of the pattern.