EUR/USD

In the early hours of Thursday, the euro had gained strength against the dollar, and with the opening of the European session, it was quoted at a daily high of about 1.0505. There, however, the uptrend found resistance, and shortly before the release of the retail data for the United States, the currency pair started its decline. The data strengthened the dollar and the pair bottomed out at around its key level of 1.0358. Shortly afterwards, at 18:00 GMT, the U.S. Federal Reserve decided to increase the key interest rate by 0.75 basis points – a decision they had not made since 1994. The effect was not delayed and we saw a 85-pip bounce from the bottom that ended the trading session at 1.0445. The probability for the dollar to continue rising after the Fed’s decision is high, and this could seriously affect the prolonged decline of the euro. However, whether we will see a higher correction and a follow-up bear attack will largely depend on the market reaction following the announcement of the unemployment claims data for the United States, which is expected today at 12:30 GMT.

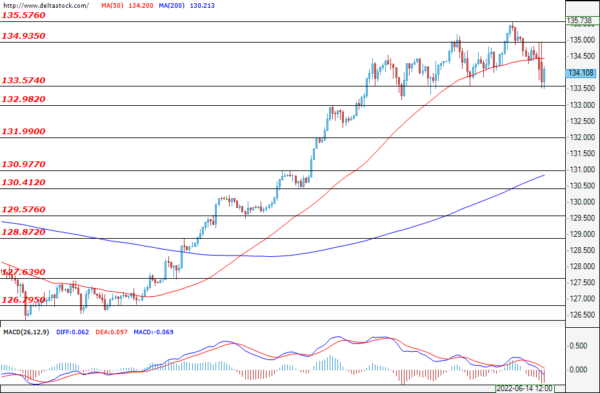

USD/JPY

In the early hours of Thursday, the USD/JPY managed to reach a new monthly peak of 135.57. There, however, the bears found a good entry point, and after breaching the key level of 135.00, they managed to continue the pair’s decline following a short break. The decision to raise the U.S. interest rate had a negative effect on the currency pair and the correction deepened towards the support at 133.57. The day ended not far from it at prices of around 133.72. The trend is likely to continue in the upward direction and to mark new highs, as the Japanese bank is not expected to raise its interest rate this Friday. Still, a deepening of the correction towards the levels at around 133.00 should not be excluded, as the price provides a good market entry point for newly arriving bulls.

GBP/USD

After finding its weekly low at 1.1931, the pound continued to rise throughout today’s early session. The weak dollar at the beginning of the day gave the bulls the strength to extend their attack towards the level at around 1.2121 following a short break and just a few hours before the Fed’s decision. After seeing the rise in the key interest rate of the U.S. to 1.75%, the sterling took advantage and continued its growth by rebounding from its key level of 1.2038. It then managed to reach 1.2202 as well and end the day a few pips below its peak. Today, everyone’s eyes will be on the Bank of England’s interest rate decision that is scheduled to be released at 11:00 GMT. The expectations are for a growth of 0.25%, but rumours are for a larger hike of 50 basis points. The volatility around such data is high and there will most likely be sharp movements in both directions.

EUGERMANY40

After initially rebounding from the bottom at 13220, the EUGERMANY40 is now pressing on with its upward movement. The opening of the European session revealed high volatility and a serious battle between bears and bulls. However, as we have already mentioned, the bulls prevailed and broke through the resistance at 13400, which after a few hours became a support. After the U.S. indices rose following the Fed’s decision to raise its key interest rate by 0.75%, the German index was not late to the party and mirrored their movements, once more reaching its local peak at 13606. However, there it found resistance and closed the day at around 13544. The downward trend towards 13220 is more likely to continue, but before that could happen, we may first see a higher correction if the bears are unable to find good entry prices.

US30

Yesterday’s price action was extremely volatile for the blue-chip index. In the early hours of today’s trading, the US30 went up after initially bouncing back from the support at 30377. Traders held their breath as they awaited the Fed’s decision to raise the key interest rate for the U.S., and 30735 played the role of a light resistance. At 18:00 GMT, the unprecedented rise of 0.75% was already a fact, and within 2 hours, the US30 tested its bottom at 30176 and jumped to a new daily high of 31000. Such volatile movements, however, are typical around key interest rate data, and so the index is expected to continue downward if the reaction regarding today’s U.S. unemployment data is negative, but the opposite scenario should still not be ruled out. If the bears do not find good prices today, then the price of the index may rise even higher.