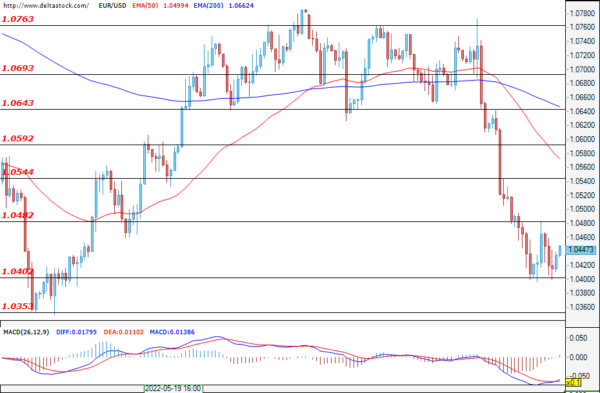

EUR/USD

Yesterday’s trading session began with a bearish dominance, but later in the day, the bulls almost recovered all of their losses. At the time of writing the analysis, the bulls have gained momentum and are aiming to reach the first resistance at 1.0480. If they do not manage to overcome the aforementioned level, then the bears will most likely regain control of the market and will try to deal with the psychological support at 1.0400 – a level that they have failed to overcome in recent days. The most important event for today is the announcement of the Fed’s interest rate decision (18:00 GMT), with traders becoming more and more convinced that the central bank will hike the rate by 75 basis points. If this proves to be the case, then this will be the biggest increase since 1991 and volatility will be extremely high.

USD/JPY

For the Ninja, yesterday’s trading session was marked by a breach of the resistance at 134.50, and the bulls are now targeting the one at 137.00 – a level that has so far not been reached in the 21st century. At the time of writing, the bears have started a corrective move towards the first support at 134.50. If they are able to overcome it, then the next obstacle in front of them would be the support at 133.15.

GBP/USD

The bears tested the support at 1.1950, but failed to overcome it, and after their failure, the bulls managed to regain some of their market positions. At the time of writing the analysis, traders are trying to stage a rally towards the first resistance at 1.2121. The next key resistance would be the level at 1.2267, with the current move most likely being a corrective one. The Bank Of England interest rate decision on Thursday (11:00 GMT) and today’s Fed decision on whether to hike the rates by 50 bps or 75 bps (18:00 GMT) and the follow-up press conference (18:30 GMT) will have a strong impact on the currency this week.

EUGERMANY40

The German index continues to consolidate around the key level at 13350 as today’s session will most likely be relatively uneventful, that is until the Federal reserve announces their plans for the monetary policy in the U.S. at 18:00 GMT and at 18:30 GMT. The correlation with the U.S. indices is expected to remain extremely high and volatility will most likely be sky-high during the mentioned period.. If, despite that, the bulls end up prevailing, then the first resistance in front of them would be located at 13500. Looking from the higher time frames, we could also see the first support that the bears would have to breach, which would be the psychological level of 13000.

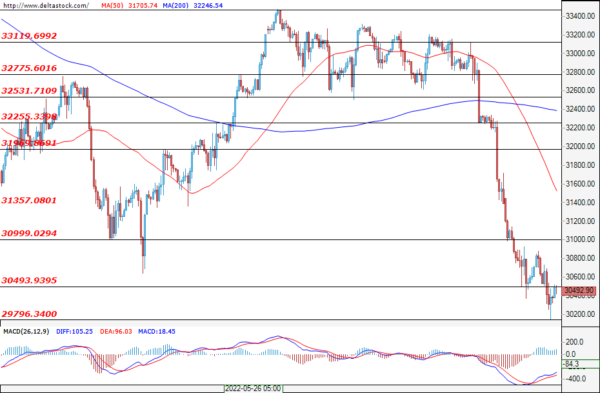

US30

The day for the U.S. blue chips began with a breach of the support from the bears at 30500, indicating that they are still in control as they tried to take the index below the level at 30000. At the time of writing of the analysis, the breach of the aforementioned level of 30500 is being confirmed. Today’s session will most likely remain relatively calm, until the storm that is the Federal Reserve engulfs the markets. If they hike the rates by 50 basis points, then the US30 will most likely go on a rally, with the main resistance being the level at 31000. However, if the decision to hike the rates by 50 bps is accompanied by Jerome Powell’s statements that there are talks of further 75 to 100 bps hikes, then the sell-off and volatility are likely to become extremely high.