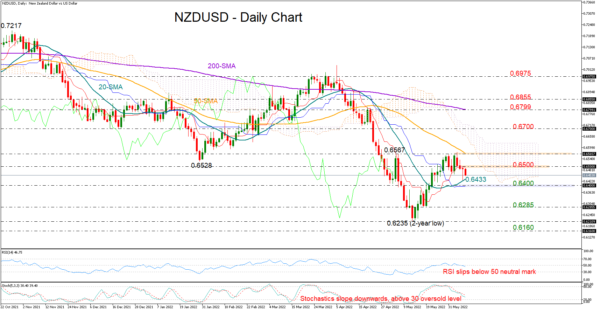

NZDUSD entered a new bearish phase last Friday after failing to chart a new higher high above May’s peak of 0.6567, with the price falling as low as 0.6421 on Tuesday.

The 20-day simple moving average (SMA) managed to add some footing under the price yesterday, though buyers did not have enough fuel to successfully drive above the red Tenkan-sen line and the 0.6500 level, keeping negative risks intact in the market.

In momentum indicators, the RSI has already entered the bearish territory below 50, while the falling Stochastics have not reached the oversold territory yet, both painting a blurry picture for short-term trading too.

Should selling tendencies intensify below the 0.6433 – 0.6400 zone, the spotlight will turn to the 0.6285 support area. The two-year low of 0.6235 could next come into view, while within breathing distance, the 0.6160 number has been a key constraining zone during the first half of 2020; therefore, it may attract special attention before the way clears towards the 0.6000 round level.

On the upside, the 0.6500 region will be closely watched in the coming sessions, though the 0.6567 barricade, where the 50-day SMA is currently located, will probably be the key for an acceleration towards the 0.6700 former boundary. If buying appetite grows further from here, traders will look for a close above the 200-day SMA currently at 0.6799, and more importantly, beyond 0.6855, before they target the March – April ceiling around 0.6975.

In brief, NZDUSD is in a discouraging situation in the short-term picture, with sellers waiting for a break below 0.6433 -0.6400 to go into full speed.