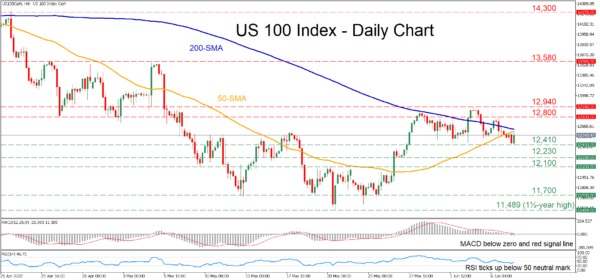

The US 100 stock index (cash) has been experiencing a minor pullback after its advance failed to cross above the 12,940 region. Nevertheless, the ascending 50-period simple moving average (SMA) is closing the gap with the 200-period SMA, where a potential upside violation could reinforce the case of a sustained recovery.

The momentum indicators suggest that bearish forces remain in control. The MACD histogram is currently beneath both zero and its red signal line, while the RSI is ticking up but remains below its 50-neutral threshold.

Should selling interest intensify further, the recent low of 12,410 could act as the first line of defence. Breaching this region, the bears might aim at 12,230 before the spotlight turns to the 12,100 level, which has acted both as support and resistance in recent months. Failing to halt there, the price could descend to challenge the 11,700 hurdle.

On the flipside, bullish actions could propel the index above both its 50- and 200-period SMAs, where the recent peak of 12,800 might act as initial resistance. Conquering this barricade, the spotlight could turn to the June high of 12,940 before 13,580 appears on the radar. Further advances may then cease at the 14,300 barrier.

In brief, the US 100 index has been experiencing a mild drop after the lower boundary of its recent sideways pattern was violated. For that bearish tone to reverse, the price needs to jump above the 12,940 ceiling.