Brent oil rose to new two-month high on Tuesday and probed through psychological $120 level, as bull-run extends into the ninth straight day and the contract is about to end the sixth consecutive month in green.

Easing of Covid restrictions in China and start of summer driving season underpin the prices, with agreement of EU leaders to cut 90% of oil imports from Russia by the end of 2022, with exemption of Hungary that marks the toughest sanction on Russia so far, additionally lifting the oil prices.

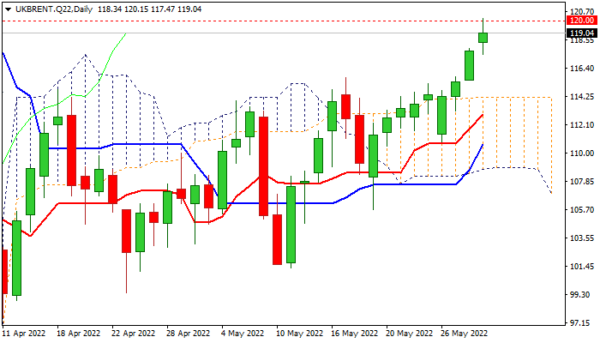

Although the fundamentals remain supportive for oil price, technical studies on daily chart show loss of bullish momentum, suggesting that bulls face strong headwinds at $120 barrier and may consolidate before resuming.

With overall picture being firmly bullish, dips are expected to provide better buying opportunities, with broken 50% retracement of $138.22/$96.92 at 117.57, offering initial and solid supports and guarding the top of thickening daily Ichimoku cloud at $114.22, which should limit extended dips.

Firm break of $120 pivot would expose targets at 122.44 (Fibo 61.8%) and $123.72 (Mar 24 peak).

Res: 120.00; 120.15; 120.87; 122.44.

Sup: 117.57; 116.20; 115.47; 114.22.