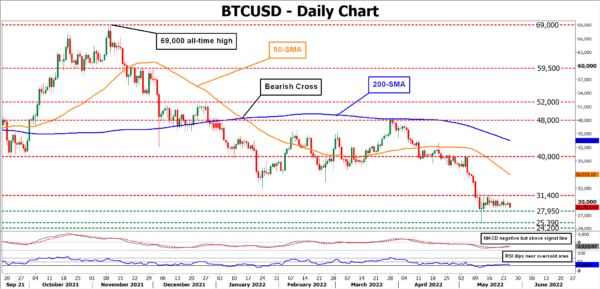

BTCUSD has been trading within a tight range during the past week, with the decline in volatility probably hinting that traders are scrutinizing the current market conditions to decide the future price direction. Nevertheless, the short-term oscillators indicate a bearish near-term bias.

Specifically, the RSI is dipping near the oversold zone, while the MACD histogram has crossed above its red signal line but remains in the negative territory.

Should selling interest intensify, the price could descend towards 27,950, which is the lower boundary of its recent rangebound pattern. Diving beneath that region, the 2022 low of 25,390 may act as a strong obstacle for the cryptocurrency. If that floor collapses, the spotlight could turn to the December 2022 resistance of 24,200.

Alternatively, bullish actions could propel the price towards the 31,400 hurdle. Conquering this barricade, the bulls might aim at the 40,000 psychological mark before 48,000 appears on the radar. Piercing through these levels, the December 2021 peak of 52,000 may cease any further advances.

Overall, BTCUSD seems to be consolidating between the 29,000-31,000 range, while near-term risks are tilted to the downside. Therefore, a break beneath the 25,390 floor could signal the resumption of its long-term downtrend.