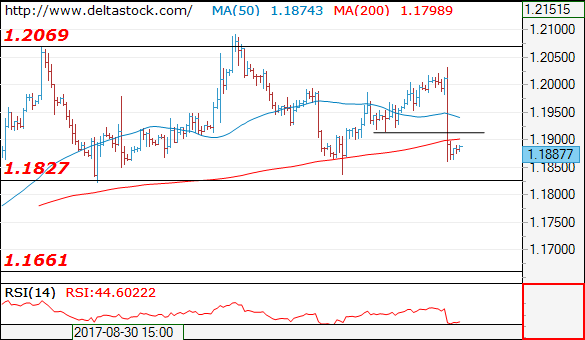

EUR/USD

Current level – 1.1887

Yesterday’s reversal at 1.2035 has been confirmed with the break through 1.1915 and the bias is negative, for a tight test of 1.1830 major support. The latter is the last hurdle before 1.1660 area.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1915 | 1.2160 | 1.1830 | 1.1830 |

| 1.2035 | 1.2500 | 1.1830 | 1.1660 |

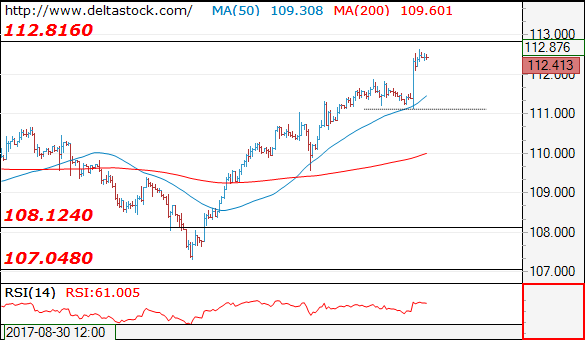

USD/JPY

Current level – 112.43

The recent consolidation built a base at 111.10 and the uptrend is intact, heading for a tight test of 112.80 resistance area. Initial intraday support lies at 111.90 and crucial on the downside is 111.10.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 112.80 | 112.80 | 111.90 | 108.12 |

| 112.80 | 114.50 | 111.10 | 107.30 |

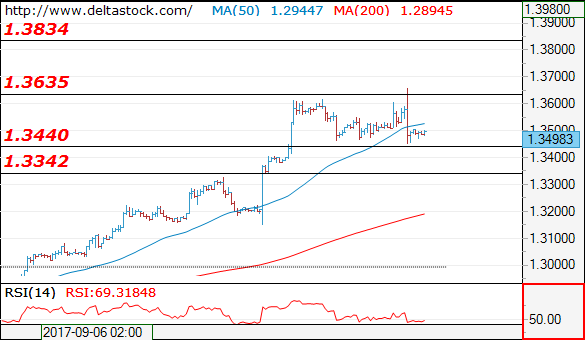

GBP/USD

Current level – 1.3498

The sharp reversal at 1.3655 signals a negative bias, for a test of 1.3440 support and a break through that area will challenge 1.3340 zone. Initial intraday resistance lies at 1.3530.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3530 | 1.3650 | 1.3440 | 1.3340 |

| 1.3650 | 1.3830 | 1.3340 | 1.3150 |