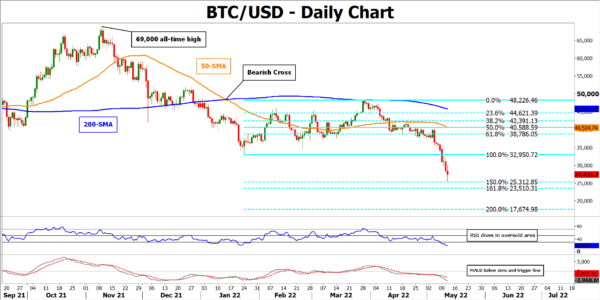

BTCUSD has come under tremendous selling pressure in the past few daily sessions, generating a fresh 16-month low. Overall, the technical picture has started to deteriorate, with a series of lower lows and lower highs forming on the daily chart.

The momentum indicators further confirm the bearish near-term bias. The RSI is dipping downwards in the oversold area, while the MACD histogram is currently beneath both zero and its red signal line.

Should negative momentum intensify, the price could generate fresh 2022 lows and might halt its decline at the 25,312 level, which is the 150% Fibonacci extension of the 32,950-48,226 up leg. Diving beneath that region, the 161.8% Fibo of 23,510 may act as the next line of defence. A violation of the latter zone could then turn the spotlight to the 200% Fibo of 17,674.

On the flipside, if the bulls re-emerge and push the price higher, initial resistance could be encountered at the 32,950 barrier. Piercing through this ceiling, the 61.8% Fibo of 38,786 may prove a tough obstacle before the attention shifts to 50% Fibo of 40,588, which overlaps with the 50-day simple moving average. Higher up, further advances could then stall at the 38.2% Fibo of 42,391.

Overall, BTCUSD remains in a sharp downtrend, while its technical picture is becoming increasingly worrisome. For that bearish tone to reverse, the price must initially jump above the 32,950 ceiling.