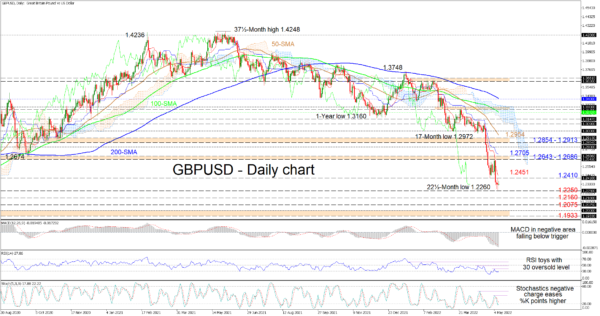

GBPUSD is consolidating after its downward trajectory approached the June 2020 low of 1.2250. Nonetheless, the falling simple moving averages (SMAs) are endorsing the bearish bias that unfolded from June 2021, even though downside forces are currently lacking.

The Ichimoku lines are indicating that selling has temporarily stalled, while the negative bias in the short-term oscillators has yet to be overturned. The MACD is signalling that sellers are not surrendering control, while the negative charge in the stochastic oscillator is revealing some weakness, as the %K line is pointing higher. Meanwhile, the RSI is relatively neutral, flirting with the 30 oversold mark.

If the current downward bearing endures, initial support could transpire from yesterday’s low of 1.2260 and the June 2020 trough of 1.2250. If the pair remains heavy, the 1.2160 barrier may be tested next, prior to sellers’ focus turning toward the May 2020 trough of 1.2075. Should selling pressures persist, the bears could then challenge the 1.1933-1.2000 support band, which stretches back to mid-March of 2020.

Alternatively, if buyers re-emerge, the 1.2410 inside swing low and the nearby red Tenkan-sen line at 1.2451 could act as preliminary friction to any positive developments in the pair. Successfully pushing higher though, the bulls may then tackle the 1.2643-1.2686 resistance band that started to evolve around mid-June 2020. Conquering this obstacle and overrunning the approaching blue Kijun-sen line at 1.2705, the price could take a crack at the 1.2800 hurdle before eyeing the 1.2854-1.2913 resistance boundary, shaped by the lows over the mid-October until early November 2020 period.

Summarizing, GBPUSD is sustaining a broader bearish bias below the SMAs and the 1.3000 border. A dive past the June 2020 trough of 1.2250 may reinforce further deterioration in the pair. That said, for optimism to begin to return, the price would need to initially climb over the 1.2643-1.2686 key barrier.