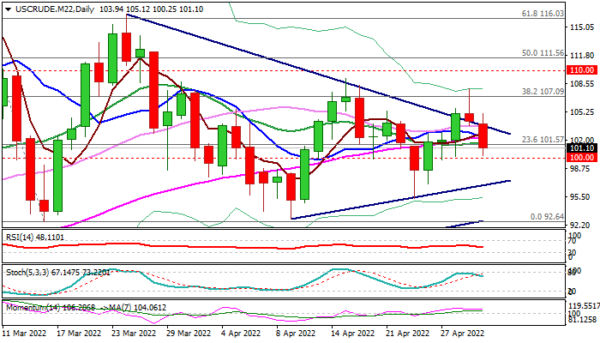

WTI oil price fell near $100 support on Monday, extending weakness after Friday’s rally stalled, ending trading in bearish candle with long upper shadow and closing below the upper boundary line of the triangle, formed on daily chart.

Fresh weakness was sparked by renewed fears about demand from China, the world’s biggest oil importer, that sidelined fears about stronger supply disruption by potential EU ban on Russian crude oil.

Near-term price action continues to move within the narrowing range, limited by a triangle and without clear direction, with mixed daily techs adding to the picture.

Bearish scenario would be activated on firm break of $100 level, but initial signal would look for confirmation on extension below triangle support line ($96.92) that would expose key supports at $92.92/64 (Mar / Apr higher base).

On the other side, sustained break above cracked triangle’s upper boundary ($103.59) would generate initial bullish signal which would look for verification on lift $107.09 (Fibo 38.2% of $130.48/$92.64), with bulls to tighten grip and sideline downside risk on lift above $110 barrier.

Res: 103.59; 105.12; 107.09; 107.95.

Sup: 100.25; 100.00; 96.92; 95.27.