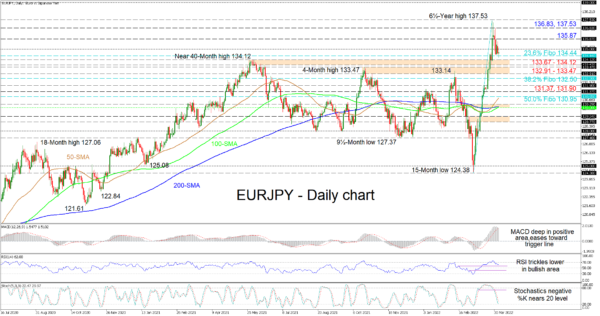

EURJPY is consolidating around the 135.00 handle after its recent pullback and has found its feet around the 134.44 level, which is the 23.6% Fibonacci retracement of the one-month rally from 124.38 until the 6½-year high of 137.53, the latter being a high that marginally breached the February 2018 peak of 137.49. Currently, the climbing 50- and 100-day simple moving averages (SMAs) do not reveal significant concerns in positive pressures, thus continuing to endorse the bullish trend.

The short-term oscillators indicate the latest surge in negative momentum but have yet to confirm that sellers are in command. The MACD, is far north of the zero mark and although easing towards its red trigger line, it is presently holding above it. The RSI is weakening ever so slightly in the bullish region, while the negatively charged stochastic oscillator promotes negative price action. However, traders need to be aware that the stochastic %K line is slowing ahead of the 20 oversold level, showing that buyers are pushing back.

If buyers create positive traction off the 23.6% Fibo of 134.44 and steer the price above the 135.00 hurdle, upside constraints could begin to emerge at the 135.87 barrier. Gaining additional buoyancy, the pair may then tackle the 136.83 high before confronting the multi-year peak of 137.53. If buying interest endures, the revival of the uptrend could cheer buyers to target the 139.00 border.

That said, more profound negative pressures would need to unfold to overwhelm the congested obstacles, which are defending the positive structure. An initial dip below the immediate 23.6% Fibo of 134.44 is faced with two critical support regions. Firstly the 133.67-134.12 area formed by the June 2021 highs followed by the 132.91-133.47 region moulded by the October 2021 highs. In the event sellers triumph, they may then meet the 38.2% Fibo of 132.50 prior to a support section between the 131.90 and 131.37 barriers. Maintaining command, the bears may seek out the 50.0% Fibo of 130.95.

Summarizing, EURJPY is sustaining a bullish bias above the near 40-month high of 134.12 and if the 23.6% Fibo acts as a foothold, this could reinforce confidence in the pair. Yet, if the price sinks below the 132.91-133.47 support obstacle, this could nurture negative tendencies in the pair.