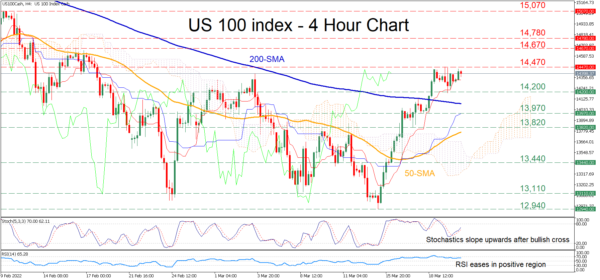

The US 100 stock index (cash) has been recovering on the four-hour chart, managing to erase some of its recent decline. Although the price has been moving sideways in the last few sessions, the ascending 50-period simple moving average (SMA) is closing the gap with the 200-period SMA, where a potential crossover could reinforce the case of a sustained uptrend.

The momentum indicators suggest that bullish forces remain active. The stochastic oscillator is marching higher after posting a bullish cross, while the RSI is hovering above its 50-neutral threshold. Moreover, the price is trading beyond the Ichimoku cloud, endorsing a broader positive short-term picture.

Should the positive momentum intensify, immediate resistance could be encountered at 14,470, which is the upper boundary of the index’s sideways pattern. Crossing above this region, the bulls might target the 14,670 barrier before the price ascends towards the 14,780 resistance region. Piercing through these levels, the spotlight could turn to the February high of 15,070.

On the flipside, if bearish forces regain the upper hand, the index may dip towards its recent low of 14,200. Further downside pressure could send the price to test the 13,970 obstacle. Falling beneath this hurdle, the price decline could halt at 13,820 before the 13,440 barricade appears on the radar.

Overall, the US 100 stock index seems to be consolidating after staging a significant recovery, while near-term risks remain tilted to the upside. Therefore, a clear jump above the 14,470 ceiling could attract further buying interest, signaling the continuation of the recent rebound.