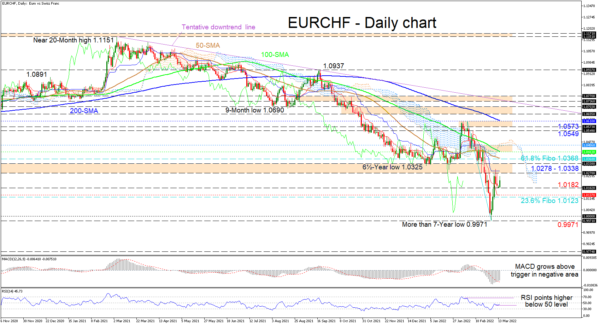

EURCHF has established a foothold around 1.0182 and above the 1.0123 level, which is the 23.6% Fibonacci retracement of the down wave from 1.0610 until a more than 7-year low of 0.9971, signalling that buyers are starting to reap some rewards from the recent bounce in the pair. Despite the fresh progress in the pair, the descending simple moving averages (SMAs) are backing the one-year decline from the 1.1151 high.

The Ichimoku lines are indicating a significant dry up in negative pressures but have yet to confirm that buyers have gained the upper hand. That said, the short-term oscillators are reflecting the increase in bullish momentum. The MACD, far beneath zero, is improving over its red signal line, while the RSI is pointing higher, marginally underneath the 50 neutral threshold.

The road higher in the pair looks to be a difficult one with congested obstacles ahead, possibly starting with the initial 1.0278-1.0338 boundary (previous support-now-resistance), which stretches back to May 2015. Slightly overhead is the 61.8% Fibo of 1.0368 that may impede buyers from challenging the 1.0413-1.0456 resistance zone, the former being the 100-day SMA and the latter the Ichimoku cloud’s lower surface. Optimism in the pair could return if the price oversteps the cloud, which may then turn the focus to the 1.0549 barrier and the neighbouring 1.0573-1.0610 resistance band.

Alternatively, if positive forces start to fade, support could begin at the 1.0182 low prior to sellers confronting the red-Tenkan-sen line at 1.0137, coupled with the 23.6% Fibo at 1.0123. Should the price dive back beneath the 23.6% Fibo, the critical support base between the 1.0000 round mark and the more than 7-year trough of 0.9971 could draw serious attention.

Summarizing, EURCHF is sustaining a broader bearish trend below the SMAs and the 1.0610 high. If buyers fail to push north of the 1.0278-1.0338 boundary, this could add credence to the negative outlook.