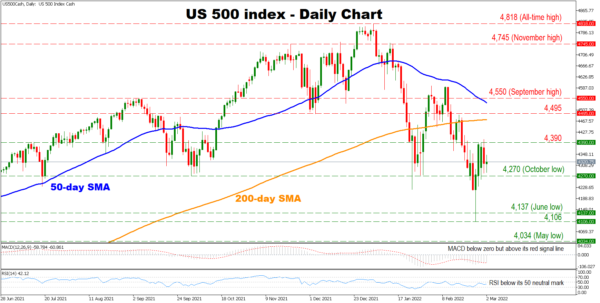

The US 500 cash index has quickly bounced above its 9-month low at 4,106 touched last week. However, the elevated negative pressures are still troubling the index, which is currently trading well below its 50- and 200-day simple moving averages (SMAs), reflecting an overall bearish outlook.

The short-term momentum indicators are painting a mixed picture as the RSI steady below its 50 neutral mark. On the country, the MACD is found below zero but above its red signal line, which indicates that the negative momentum in the price might be fading.

Should the bears maintain control, the October low at 4,270 might act as the first line of support, before sellers target the June low at 4,137. A break below this point could pave the way towards the 4,106 hurdle. Breaching below this point could intensify selling pressures, opening the door towards the May low at 4,034.

On the flip side, if the bulls resurface, initial resistance might be found at the 4,390 level before buyers take aim at the consecutive hurdles of the 200-day SMA currently at 4,473 and the 4,495 obstacle. A break above the latter could send the price towards the region which includes the 50-day SMA currently at 4,534 and the 4,550 barrier. Moving above this region could turn the fortunes around for the index, opening the door towards the November high of 4,745.

In brief, the overall outlook for the pair remains bearish. For sentiment to change, buyers would need to break above the 50-day SMA.