WTI oil futures (March delivery) drifted higher during the early European trading hours on Thursday in an attempt to pare the two-day losing streak which stalled around the 90 level.

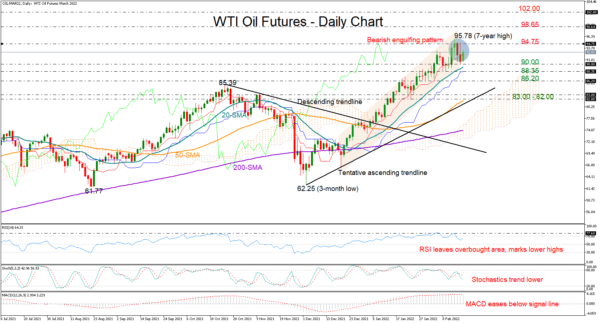

The market is still in a clear uptrend so far this year, keeping its bullish outlook well intact. But some discouraging signals are becoming evident in the very short-term picture. First, the price closed below the red Tenkan-sen line on Wednesday, which has been supporting the market since the start of January. Secondly, the candlestick structure following the peak at a 95.78 on Monday reminds of a bearish engulfing pattern – a signal that sellers are overtaking buyers and therefore lower prices are to come. It’s also worthy to note that the momentum indicators have already printed lower highs, with the MACD easing below its red signal line.

Nevertheless, bearish actions could remain constrained and temporary unless the price dips below the 90.00 number to close beneath the key 88.35 handle. If that is the case, the decline could lengthen towards the 86.20 support region, where any violation could squeeze the price towards the 83.00 – 82.00 zone.

On the flip side, if the bulls defend the uptrend above 90.00, traders will be eagerly waiting for a break above the 94.75 resistance before they target the 98.65 barricade, which has been limiting downside and upside movements during the 2011 – 2014 period. Additional gains above the latter may stall within the 100.00 – 102.00 restrictive area.

In brief, although the uptrend in WTI oil futures remains well established, there are some signs that the bulls are losing energy. Yet only a significant move below 88.35 could confirm that.