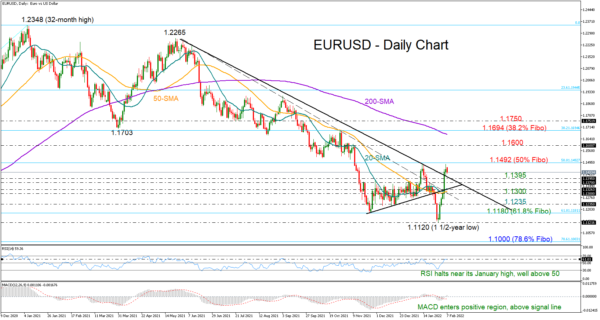

EURUSD started the month on the right foot last week, charting its fastest weekly rebound since March 2020 to advance from a 1½-year low of 1.1120 straight back into the 1.1400 zone.

Encouragingly, the bulls’ fortunes have improved following the peak above the key resistance trendline drawn from May’s high of 1.2265, but downside risks have not fully evaporated since last week’s thrilling rally was not enough to drive the price above its previous high of 1.1492. Notably, that level is coinciding with the 50% Fibonacci retracement of the 2020 uptrend, which topped at a 32-month high of 1.2348.

Will the bulls continue to march higher in the coming sessions? Well, the technical picture is still favouring the case. Even though the RSI is currently struggling to surpass its January high, the indicator is comfortably above its 50 neutral mark, suggesting buying pressures may keep balancing any sharp declines. Likewise, the MACD remains positively charged above its zero and signal lines, while in trend indicators, the positive intersection between the 20- and 50-day simple moving averages (SMAs) is still valid.

A decisive close above the 1.1492 bar could push the price up to the 1.1600 hurdle. Claiming that area, the next crucial obstacle may emerge around the 200-day SMA and the 38.2% Fibonacci of 1.1694, while not far above, the 1.1750 level could be another barricade.

On the downside, the bears will need to squeeze the price back below the 1.1395 – 1.1300 territory of trendlines in order to regain command. Then, a forceful extension below the former support region of 1.1235 – 1.1180, which encapsulates the 61.8% Fibonacci, may threaten the resumption of the long-term downtrend below the 1.1120 bottom, bringing the 1.1000 number back into focus.

In brief, EURUSD is taking a breather following its recent impressive rebound. Although the bias remains titled to the upside, the bulls have another mission to accomplish before they declare victory. Particularly, they need to successfully close the gap with the 1.1492 barrier to dominate the market in the short term.