EUR/USD

At the end of last week, the rally lost its momentum and the currency pair made an unsuccessful test of the important resistance level of 1.1480. The forecast is for the pair to consolidate in the zone between 1.1362 and 1.1480, before the bulls are to re-test the resistance at 1.1480. In the negative direction, the first support lies at 1.1362. Among the important news for traders this week is the U.S. core CPI data, as well as the U.S. initial jobless claims report. Both of them are to be announced on Thursday at 13:30 GMT.

USD/JPY

At the end of last week, the Ninja breached the resistance level of 115.00 and is now expected to continue rising towards the next resistance zone at 115.63. In case this zone is tested and violated, then the next target for the pair would be found at 116.16. In the negative direction, the former resistance at 115.00 is now acting as support.

GBP/USD

The appreciation of the British pound against the dollar was limited slightly below the resistance zone of 1.3650 and the pair subsequently failed to stay above 1.3570. The expectations are for the pair to continue losing ground and to consecutively test the support levels at 1.3444 and at 1.3370. In the positive direction, the first significant resistance lies at 1.3570. This week, increased trading activity can be expected around the announcement of the U.K. manufacturing production data and the U.K. GDP data. Both of them are to be announced on Friday at 07:00 GMT.

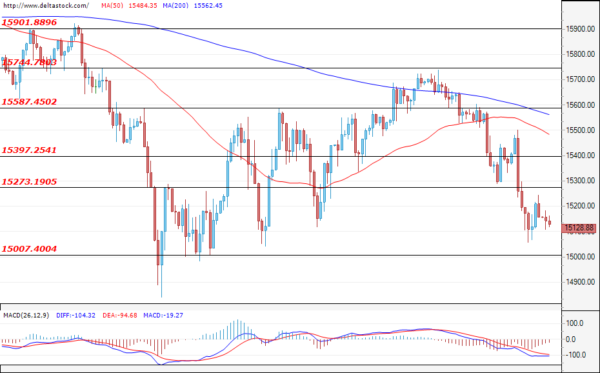

EUGERMANY40

During the last trading session of the previous week, the German index breached the support level of 15273 and, at the time of writing the analysis, is consolidating in the zone between 15000 and 15273. The forecast is for the index to continue trading in this zone as it waits for a catalyst, which could help either the bulls or the bears prevail and determine the future direction of the EUGERMANY40.

US30

At the end of last week, the appreciation of the U.S. blue-chip stock index was limited around the resistance at 35524 and the index started to depreciate afterwards. At the time of writing, the US30 is headed towards a test of the support level at 34995. A possible breach of this support would deepen the retracement, pushing the US30 towards a test of 34445. If the support at 34995 withstands the bearish pressure, then the most likely scenario would be for the index to re-test the resistance at 35524. Among the important news for traders this week is the U.S. core CPI data, as well as the U.S. initial jobless claims report. Both of them are to be announced on Thursday at 13:30 GMT.