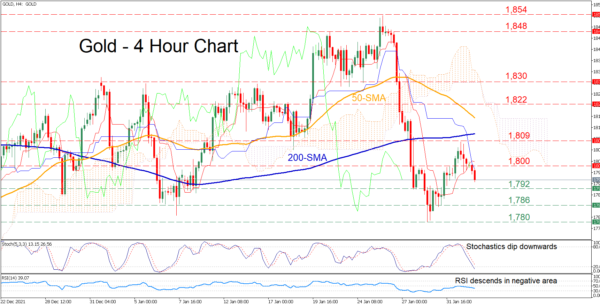

Gold has managed to stage a partial rebound after its sharp decline halted at the 1,780 region. However, the near-term picture has deteriorated again, with the bullion losing some ground in the last few four-hour sessions.

This recent pullback from 1,854 is likely to resume as momentum indicators confirm the loss of steam for the commodity. The stochastic oscillator is sloping downwards near the oversold area, while the RSI is ticking down beneath the 50-neutral mark. Moreover, the price is currently trading far below the Ichimoku cloud, endorsing the broader bearish picture for the precious metal.

Should the negative momentum intensify further, the price might dip towards the 1,792 barrier. Failing to halt there, the bears could target the 1,786 level. Violating this support point, the spotlight would turn to the January low of 1,780.

On the flipside, if buyers re-emerge and regain the upper hand, initial resistance may be encountered at the 1,800 psychological mark. Overstepping this region, the price could test 1,809 before it ascends towards the 1,822 hurdle. Higher up, further upside advances might cease at the 1,830 obstacle.

In brief, gold’s rebound seems to be in danger as the positive momentum has failed to intensify, while near-term risks remain tilted to the downside. Therefore, only a profound cross above 1,809 could signal the continuation of the short-term recovery for the precious metal.