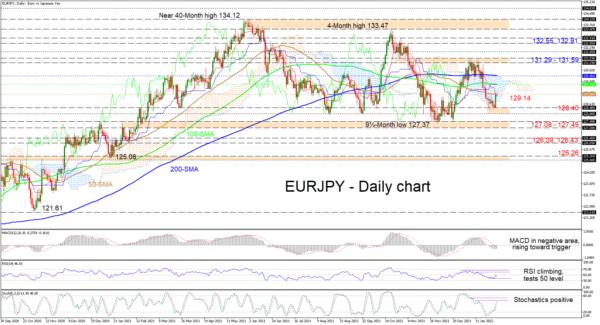

EURJPY buyers have managed to recoup the last week of losses through yesterday’s trading session and are now struggling to beat the 50-day simple moving average (SMA) at 129.26. The positive price action has underpinned the sideways bearing in the pair that has extended for around half a year, an outlook that the SMAs are endorsing too.

Currently, the Ichimoku lines are not indicating a convincing direction in the pair, while the short-term oscillators are reflecting conflicting energy in directional momentum. The MACD, some distance below zero, is rebounding higher towards the red trigger line, while the RSI is failing to overstep the 50 threshold. The positively charged stochastic oscillator continues to sponsor gains in the pair.

If buyers nudge past the 50-day SMA at 129.26, additional advances in the pair could face tough resistance between the 100- and 200-day SMAs at 129.90 and 130.46 respectively. A successful climb above the Ichimoku cloud’s upper band – overlapped by the 200-day SMA – may boost upside momentum to challenge the 131.29-131.59 resistance border. Should the bulls conquer this barrier too, they could then eye the 132.00 hurdle before their focus turns to the 132.55 and 132.91 subsequent highs.

Otherwise, if positive pressures continue to abate at the 50-day SMA, the initial 128.00-128.40 area could try to prevent a drop in the pair from accelerating. However, should negative pressures overwhelm this zone, the 127.08-127.49 support foundation may then contest the intensity of selling in the pair. Furthermore, if this one-year base fails to dismiss a decline from snowballing, the price could snag around the 126.43 and 126.09 lows before confronting the 125.00-125.26 support border that extends back to October 2020.

Summarizing, EURJPY is rangebound between the 127.08-127.49 floor and the 133.47-134.12 ceiling. That said, a dip beneath 128.00 could feed negative pressures, while a hike beyond the 131.59 high would be necessary to boost optimism in the pair.