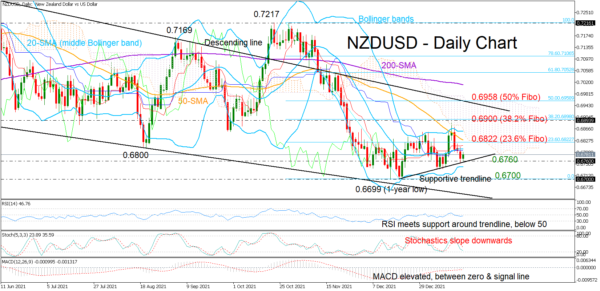

NZDUSD has been quite unstable, oscillating between gains and losses within the 0.6700 – 0.6900 territory since the drop to a one-year low of 0.6699 in December. Yet, despite the fluctuations, the pair managed to build a soft upward trajectory in the short-term picture with the help of a strong supportive trendline.

The 20-day simple moving average (SMA), which represents the middle Bollinger band, is currently blocking bullish actions around the 0.6800 round level as the momentum indicators provide little direction about what the next move in the price could be. The RSI has yet to set a foothold within the bullish area despite maintaining a positive trend above an ascending trendline, currently hovering marginally below its 50 neutral mark. The MACD is also following a positive direction, though it is still trapped between its red signal and zero lines, while the Stochastics keep sloping downwards.

The 0.6800 – 0.6820 region, which encapsulates the 20- and 50-day SMAs and the 23.6% Fibonacci retracement of the 0.7217 – 0.6699 down leg, is currently the main target. A successful step above it could generate additional upside corrections up to the 38.2% Fibonacci of 0.6900, where the price almost topped last week. Further up, the bulls may attempt to breach the descending trendline from February 2021 and the 50% Fibonacci of 0.6958.

On the downside, the short-term supportive trendline is preserving some optimism in the market for now. Should it crack, the price will probably see another test near the one-year low of 0.6699 before it seeks shelter again around the downward-sloping line stretched from March 2021 at 0.6650. Lower, the pair would strengthen its broad bearish outlook, shifting attention to the 0.6600 and 0.6500 psychological marks.

In brief, although technical signals are unclear at the moment, the soft upward pattern in the short-term picture could feed buying interest, making additional higher highs above 0.6900 likely. Otherwise, a close below the ascending trendline at 0.6760 would bring bearish risks back into play.