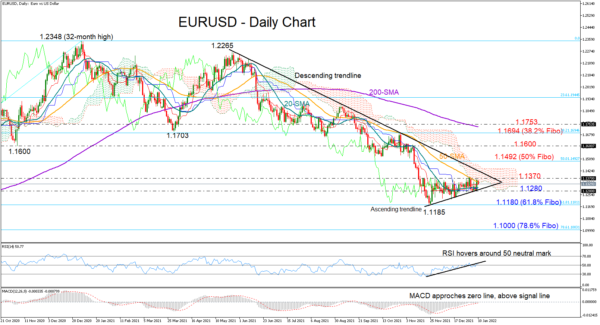

EURUSD resumed its negative momentum during Monday’s early European trading hours after barely closing above the restrictive 50-day simple moving average (SMA) on Friday at 1.1359.

As long as the ascending trendline is building the soft upward trajectory in the short-term picture, the focus will remain on the upside. That said, the momentum indicators have not clarified strong bullish signals yet, suggesting that traders could keep behaving carefully for a bit longer. Particularly, the RSI continues to fluctuate around its 50 neutral mark, recently hitting a wall around the support-turned-resistance trendline, while the MACD is struggling to enter the positive territory.

A decisive close above the key 1.1370 – 1.1400 zone, which contains the tough descending trendline from the 1.2265 high could be the prerequisite for driving the price straight up to the 50% Fibonacci retracement of the 2020 rally (1.0636 -1.2348) at 1.1492. A steeper increase could examine the 1.1600 psychological level, a break of which would open the door for the 38.2% Fibonacci of 1.1694 and the 200-day SMA at 1.1753.

Alternatively, a step below the short-term supportive trendline at 1.1280 would dash any hopes for improvement, bringing the 1½-year low of 1.1185 back under the spotlight. Failure to bounce back here could activate fresh selling orders, likely sending the price forcefully towards the 78.6% Fibonacci of 1.1000. If downside pressures persist, the next potential pivot point could develop around the 1.0870 barrier, which has been effective during the end of 2019 to mid-2020.

All in all, although EURUSD is still displaying an unclear technical picture at the moment, the strong footing around the supportive trendline may keep buying interest intact during the coming sessions.