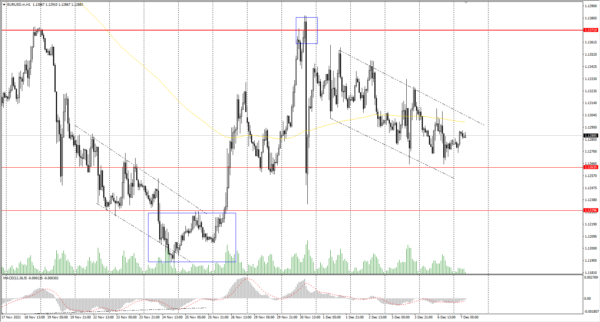

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1301

Prev Close: 1.1285

% chg. over the last day: -0.14%

The ECB officials believe that the current monetary policy of the ECB is adequate and the stimulus program is necessary for the current environment. At the same time, inflation expectations in the region show a constant growth trend. The European currency does not have any fundamental factors for strengthening at the moment.

Trading recommendations

Support levels: 1.1263, 1.1230, 1.1168

Resistance levels: 1.1371, 1.1436, 1.1535, 1.1613, 1.1667, 1.1717

From a technical point of view, the EUR/USD on the hour time frame is still bearish. The price is currently trading in a corridor. The MACD indicator has become inactive. Under such market conditions, traders should consider sell positions from the priority change level of 1.1371. Buy trades should be considered only from the support levels of the higher time frame, given the buyers’ initiative, but only with short targets.

Alternative scenario: if the price breaks out through the 1.1371 resistance level and fixes above, the mid-term uptrend will likely resume.

News feed for 2021.12.07:

- German Industrial Production (m/m) at 09:00 (GMT+2);

- Germany ZEW Economic Sentiment (m/m) at 12:00 (GMT+2);

- Eurozone ZEW Economic Sentiment (m/m) at 12:00 (GMT+2);

- Eurozone GDP (q/q) at 12:00 (GMT+2).

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3212

Prev Close: 1.3262

% chg. over the last day: +0.38%

According to a new forecast from the CBI business group, the UK economic recovery will remain resilient. However, costs and supply shortages are hurting the UK economic growth prospects, and Omicron may add additional risk. The British pound came under pressure last week since the Bank of England may postpone an interest rate hike until 2022.

Trading recommendations

Support levels: 1.3232

Resistance levels: 1.3308, 1.3360, 1.3434, 1.3507, 1.3575, 1.3685, 1.3748

On the hourly time frame, the trend on GBP/USD is bearish. A narrowing of liquidity in the form of a “triangle” pattern was in the direction of sales, but yesterday, the buyers showed initiative. The MACD indicator became positive. Under such market conditions, traders should consider selling positions from the moving average’s resistance levels. Buy trades should be considered from the buyers’ initiative zone, but only with short targets.

Alternative scenario: if the price breaks out through the 1.3359 resistance level and consolidates above, the bullish scenario will likely resume.

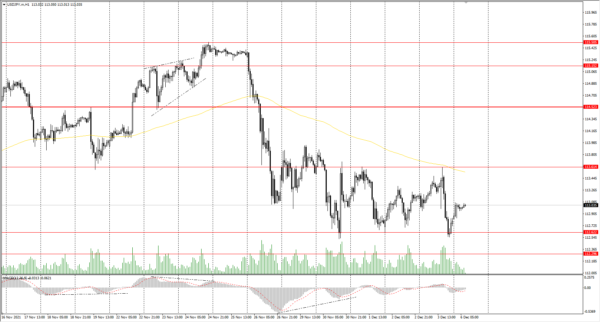

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 112.83

Prev Close: 113.49

% chg. over the last day: +0.59%

The Japanese yen is declining against the US dollar as the risks associated with the Omicron strain begin to decrease. The monetary policy of Japan’s central bank is now aimed at stimulating the economy, while the Fed is already reducing its QE program, so from a fundamental point of view, the USD/JPY quotes are inclined to grow.

Trading recommendations

Support levels: 113.61, 112.62, 112.30

Resistance levels: 114.48, 115.15, 115.50

The global trend on the USD/JPY currency pair is bearish. At the moment, the price is trading in the corridor, but the pressure of buyers is increasing. Under such market conditions, it is best for traders to look for sell positions from the resistance levels around the moving average or from the upper border of the corridor, but with additional confirmation. Buy positions should be considered from the lower border of the corridor, but with additional confirmation in the form of a buyers’ initiative.

Alternative scenario: if the price rises above 114.17, the uptrend will likely resume.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2827

Prev Close: 1.2757

% chg. over the last day: -0.55%

The Canadian dollar is strengthening amid rising oil prices and as the Central Bank of Canada seeks to raise interest rates. A Reuters forecast with 32 strategists shows that the Canadian dollar will strengthen by 2.4% to 1.25 per US dollar in three months. However, traders should keep in mind that the dollar index is also strengthening right now as the QE program is reducing, which may cause the USD/CAD currency pair to take a flat position.

Trading recommendations

Support levels: 1.2726, 1.2646, 1.2598, 1.2571, 1.2483, 1.2416, 1.2388

Resistance levels: 1.2828

From a technical point of view, the USD/CAD currency trend is bullish. The price is trading flat in the corridor with a range of 1.2726-1.2828. The MACD indicator has become negative. Under such market conditions, it is better to look for buy trades from the lower border of the flat corridor. Sell deals should be considered from the resistance levels of the higher time frames, given the seller’s initiative.

Alternative scenario: if the price breaks down through the 1.2687 support level and fixes below, the downtrend will likely resume.

News feed for 2021.12.07:

- Canada Ivey PMI (m/m) at 17:00 (GMT+2).