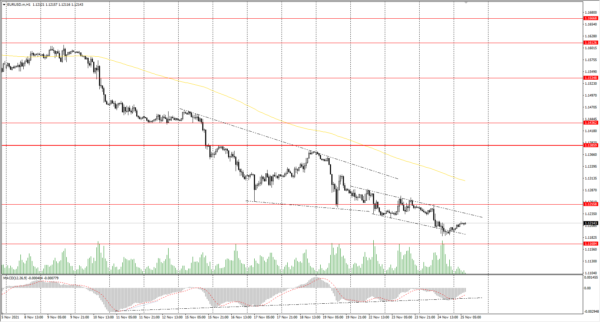

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1246

Prev Close: 1.1200

% chg. over the last day: -0.41%

The Euro fell to a new yearly low after disappointing data from the Ifo business climate in Germany. The Ifo business climate in Germany declined for the 5th month in a row to 96.5 in November against expectations of 96.6. Germany said it will implement a full isolation today.

Trading recommendations

Support levels: 1.1168

Resistance levels: 1.1256, 1.1386, 1.1436, 1.1535, 1.1613, 1.1667, 1.1717

From a technical point of view, the EUR/USD is bearish on the hour time frame. The Euro continues to show weakness, the price is slowly declining, and buyers’ attempts to buy back the movement give only a small intraday bounce. The MACD indicator has become inactive, but there are signs of divergence at several timeframes, so traders should expect a technical rebound. Under such market conditions, traders should consider sell positions from the resistance levels near the moving average since the price has strongly deviated from the averages. Buy trades should be considered only from the support levels of the higher time frame, given the buyers’ initiative, but only with short targets.

Alternative scenario: if the price breaks out through the 1.1386 resistance level and fixes above, the mid-term uptrend will likely resume.

News feed for 2021.11.25:

- Germany GDP (q/q) at 09:00 (GMT+2);

- Eurozone ECB Monetary Policy Meeting Accounts At 14:30 (GMT+2);

- Eurozone ECB President Lagarde’s Speech at 15:30 (GMT+2).

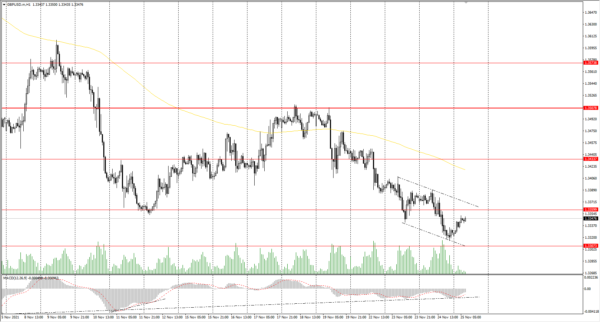

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3373

Prev Close: 1.3327

% chg. over the last day: -0.34%

The British pound also could not resist the strength of the US dollar. Despite rising Brent crude oil prices and rising business activity in the country, the British pound is also declining. Even the expectation of an interest rate hike from the Bank of England is not supporting the pound.

Trading recommendations

Support levels: 1.3307

Resistance levels: 1.3360, 1.3434, 1.3507, 1.3575, 1.3685, 1.3748

On the hourly time frame, the trend on GBP/USD is bearish. The MACD indicator has become inactive but is signaling divergence on several time frames. Under such market conditions, traders should consider sell positions from the support levels around the moving average. It is important for the buyers to get the price back above the 1.3360 level, so buy trades should be considered only if the price returns to the 1.3360-1.3507 corridor, given the buyers’ initiative.

Alternative scenario: if the price breaks out through the 1.3507 resistance level and consolidates above, the bullish scenario will likely resume.

News feed for 2021.11.25:

- UK BoE Gov Andrew Bailey’s Speech at 19:00 (GMT+2).

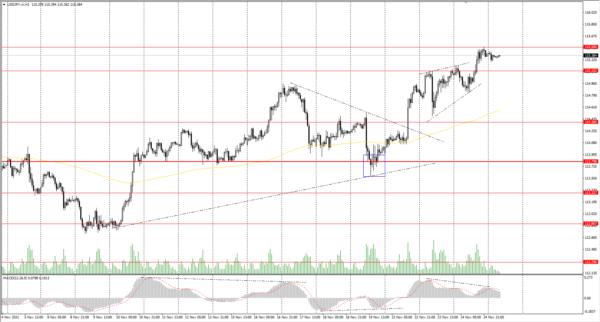

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 115.12

Prev Close: 115.40

% chg. over the last day: +0.24%

Japan decided to issue ¥22.1 trillion ($192 billion) in new government bonds to finance an additional budget for the current fiscal year through next March to help finance the COVID-19 pandemic economic stimulus package. The ¥31.6 trillion ($274 billion) supplementary budget, expected to be approved by the Cabinet on Friday, will be used mainly for coronavirus measures. Some analysts have questioned the need for so much spending now, given that the worst of the pandemic appears over and the economy was forecast to rebound on its own.

Trading recommendations

Support levels: 115.15, 114.38, 113.79, 113.32, 112.87, 112.30

Resistance levels: 115.50

The global trend on the USD/JPY currency pair is bullish. The MACD indicator is positive, but there are the first signs of divergence. Under such market conditions, it’s better to look for buy positions from the buyers’ initiative zone near the moving average. Sell positions should be considered from the resistance levels of higher time frames, given there is sellers’ initiative, but only with short targets.

Alternative scenario: if the price falls below 113.79, the uptrend will likely be broken.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2666

Prev Close: 1.2664

% chg. over the last day: -0.02%

The Canadian dollar is the only currency that opposes the dollar index growth and shows some strength because of oil prices growth. Yesterday, both the dollar index and oil prices increased. As a result, the USD/CAD currency pair was trading flat. Fundamentally, both the dollar index and oil quotes tend to grow, so the USD/CAD may form a wide flat.

Trading recommendations

Support levels: 1.2646, 1.2598, 1.2571, 1.2483, 1.2416, 1.2388

Resistance levels: 1.2729

From a technical point of view, the trend of the USD/CAD currency is bullish. The MACD indicator has become negative. Under such market conditions, it is better to look for buy trades from the support levels near the moving average. Sell deals should be considered from the resistance levels of the higher time frames.

Alternative scenario: if the price breaks down through the 1.2571 support level and fixes below, the downtrend will likely resume.