EUR/USD

Current level – 1.1630

The currency pair continues its corrective phase after it had previously reached the local bottom of 1.1582 and, at the time of writing the analysis, the EUR/USD is headed towards a test of the resistance level of 1.1640. A successful breach would allow the bulls to attack the resistance zone of 1.1690. Alternatively, if the test fails, the most likely scenario would be for the pair to retrace and consolidate at around 1.1580. During today’s session, volatility could spike when the data for the building permits for the U.S. is announced (12:30 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1640 | 1.1750 | 1.1582 | 1.1410 |

| 1.1687 | 1.1800 | 1.1528 | 1.1280 |

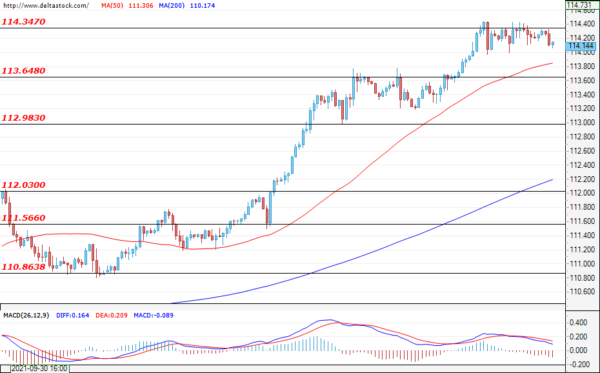

USD/JPY

Current level – 114.14

The currency pair is facing difficulties in overcoming the local resistance of 114.34 as it made a couple of unsuccessful attempts to breach it lately. The two possible scenarios are for the pair to consolidate at 114.10 or to enter a corrective phase and test the support of 113.64, but both are expected to lead to a new test of 114.34, which would pave the way for the pair towards the 115.60 zone.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 114.34 | 117.90 | 113.64 | 112.00 |

| 115.60 | 118.50 | 113.00 | 111.56 |

GBP/USD

Current level – 1.3755

The pound continues to appreciate against the dollar as the pair managed to breach the key resistance level of 1.3713 and is now headed towards a test of the next resistance of 1.3760. The expectations are positive – for a new breach and rise towards the resistance zone of 1.3830. In the negative direction, the first support is found at the former resistance level of 1.3713.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3762 | 1.3830 | 1.3713 | 1.3570 |

| 1.3830 | 1.3900 | 1.3666 | 1.3420 |