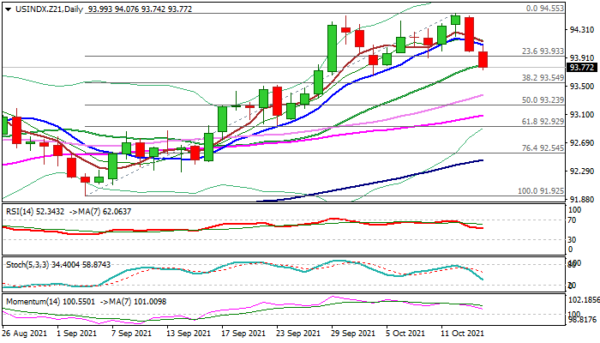

The dollar extends lower on Thursday, following Wednesday’s 0.52% drop, with Wednesday’s close below 10DMA (94.14) and today’s drop through Fibo 23.6% of 91.92/94.55 upleg, generating initial reversal signal.

After minor negative impact from downbeat US jobs data, which were seen as temporary, investors got disappointed after the minutes of FOMC’s September meeting showed that the Fed is all but certain about start tapering of stimulus this year and increased concerns that high inflation could persist.

Larger bulls stalled on approach to 200WMA (94.63) and the price slipped from one-year high (94.55), leaving a double-top on daily chart.

Thursday’s action broke below rising 20DMA (93.80) and eye pivotal Fibo support at 93.54 (38.2% of 91.92/94.55), violation of which would confirm reversal and risk drop towards 93.23 (50% retracement) and 93.08 (55DMA).

Broken 5/10DMA’s turned south and converging, in attempt to form bear-cross and add to negative signals.

Sharp loss of bearish momentum on daily chart and south-heading indicators contribute to negative near-term outlook.

Res: 93.93, 94.09, 94.43, 94.55.

Sup: 93.66, 93.54, 93.37, 93.23.