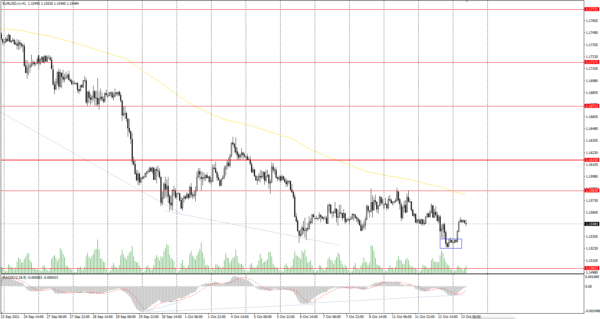

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1551

Prev Close: 1.1530

% chg. over the last day: -0.18%

German investor confidence is worsening amid raw material shortages: ZEW expectation index fell to 22.3 compared to the previous month’s value – 26.5. There is a decline in profits, especially in export-oriented companies. Economic expectations for the Eurozone have also decreased.

Trading recommendations

Support levels: 1.1502, 1.1453

Resistance levels: 1.1583, 1.1615, 1.1671, 1.1717, 1.1772, 1.1802, 1.1835

The EUR/USD trend is bearish, from the technical point of view. The MACD indicator has become inactive, but there is a divergence on bigger time frames. At the Asian session, there is buyer’s initiative today. Under such market conditions, traders should consider sell deals from the resistance levels near the moving average. It is better to look for Buy trades from the support levels or from the buyers’ initiative zone.

Alternative scenario: if the price breaks through the 1.1615 resistance level and fixes above, the mid-term uptrend is more likely to resume.

News feed for 2021.10.13:

- German Consumer Price Index (m/m) at 09:00 (GMT+3);

- Eurozone Industrial Production (m/m) at 12:00 (GMT+3);

- US Consumer Price Index (m/m) at 15:30 (GMT+3);

- US FOMC Meeting Minutes (m/m) at 21:00 (GMT+3);

- US FOMC Member Braindard’s Speech at 23:30 (GMT+3).

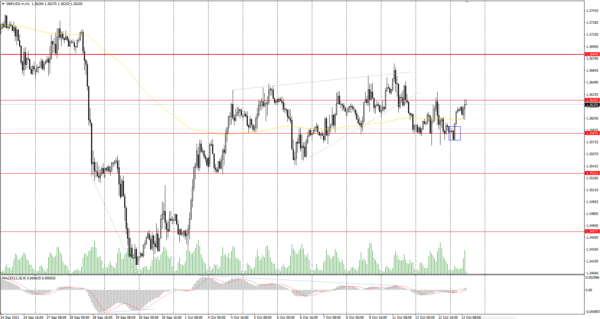

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3594

Prev Close: 1.3584

% chg. over the last day: -0.07%

Investors believe that the European Central Bank and the US Fed will adhere to an overly soft policy, while the Bank of England may commit a big mistake with its overly hawkish policy. The actual UK unemployment rate is 4.5% (forecast 4.5%, previous 4.6%).

Trading recommendations

Support levels: 1.3584, 1.3532, 1.3457, 1.3360, 1.3282

Resistance levels: 1.3626, 1.3685, 1.3759, 1.3812, 1.3886

On the hourly time frame, the GBP/USD trend is bearish. However, the British currency looks more confident than the euro due to its direct correlation with oil prices. The MACD has become inactive, and the price is trading flat. Buy trades should be considered only within the day and only from the initiative zone of the buyers. It is better to look for sell deals from the nearest resistance levels, but after an additional confirmation in the form of a sellers’ initiative, because the buyers’ pressure is higher now.

Alternative scenario: if the price breaks through the 1.3685 resistance level and consolidates above, the bullish scenario is likely to resume.

News feed for 2021.10.13:

- UK GDP (m/m) at 09:00 (GMT+3);

- UK Manufacturing Production (m/m) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3);

- US Consumer Price Index (m/m) at 15:30 (GMT+3);

- US FOMC Meeting Minutes (m/m) at 21:00 (GMT+3).

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 113.26

Prev Close: 113.60

% chg. over the last day: +0.30%

The Bank of Japan is calm about the weakness of the Japanese yen, as the weakening of the national currency boosts exports. The weaker yen is also increasing corporate spending due to higher import prices.

Trading recommendations

Support levels: 113.35, 112.19, 111.53, 110.99, 110.65, 109.95, 109.63

Resistance levels: 114.40

The main trend of the USD/JPY currency pair is bullish. The Japanese yen is rapidly declining in price against the US dollar. The MACD indicator is positive, but there are signs of divergence. Under such market conditions, it’s better to consider opening buy positions from the support levels near the moving average, since the price has deviated greatly from the average line. Sell positions should be considered only throughout the day from the resistance levels, given there is sellers’ initiative.

Alternative scenario: if the price falls below 111.53, the uptrend is likely to be broken.

News feed for 2021.10.13:

- UK GDP (m/m) at 09:00 (GMT+3);

- UK Manufacturing Production (m/m) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3);

- US Consumer Price Index (m/m) at 15:30 (GMT+3);

- US FOMC Meeting Minutes (m/m) at 21:00 (GMT+3).

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 113.26

Prev Close: 113.60

% chg. over the last day: +0.30%

The Bank of Japan is calm about the weakness of the Japanese yen, as the weakening of the national currency boosts exports. The weaker yen is also increasing corporate spending due to higher import prices.

Trading recommendations

Support levels: 113.35, 112.19, 111.53, 110.99, 110.65, 109.95, 109.63

Resistance levels: 114.40

The main trend of the USD/JPY currency pair is bullish. The Japanese yen is rapidly declining in price against the US dollar. The MACD indicator is positive, but there are signs of divergence. Under such market conditions, it’s better to consider opening buy positions from the support levels near the moving average, since the price has deviated greatly from the average line. Sell positions should be considered only throughout the day from the resistance levels, given there is sellers’ initiative.

Alternative scenario: if the price falls below 111.53, the uptrend is likely to be broken.

News feed for 2021.10.13:

- US Consumer Price Index (m/m) at 15:30 (GMT+3);

- US FOMC Meeting Minutes (m/m) at 21:00 (GMT+3).