Key Highlights

- NZD/USD started a major decline below the 0.7000 support.

- It broke a declining channel with support near 0.6950 on the 4-hours chart.

- EUR/USD declined below 1.1650, and GBP/USD accelerated lower towards 1.3400.

- The US Gross Domestic Product could grow 6.6% in Q2 2021.

NZD/USD Technical Analysis

The New Zealand dollar started a major decline from well above 0.7050 against the US Dollar. NZD/USD traded below 0.7000 to enter a bearish zone.

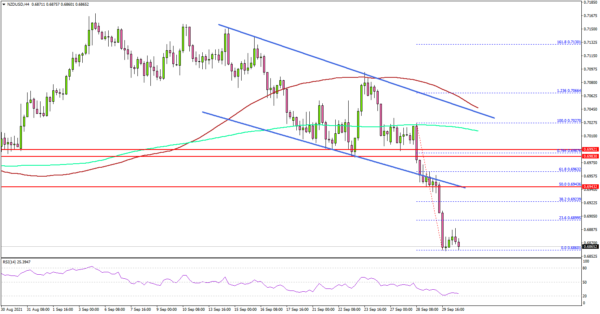

Looking at the 4-hours chart, there was a break below a declining channel with support near 0.6950. The pair settled below the 0.6950 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The pair even traded below the 0.6900 support zone. It seems like the pair might continue to move down below 0.6850. The next key support is near 0.6800, below which the pair may possibly dive towards 0.6720.

On the upside, an initial resistance is near the 0.6920 level. The first major resistance is near 0.6950, above which NZD/USD could rise towards the main 0.7000 hurdle (the recent breakdown zone).

Looking at EUR/USD, the pair declined heavily and even traded below 1.1650. Similarly, GBP/USD declined below the 1.3500 support zone.

Economic Releases

- UK GDP for Q2 2021 (QoQ) – Forecast -1.5%, versus +4.8% previous.

- Germany’s Unemployment Change for April 2021 – Forecast -33K, versus -53K previous.

- Germany’s Unemployment Rate for April 2021 – Forecast 5.6%, versus 5.5% previous.

- German Consumer Price Index for Sep 2021 (YoY) (Prelim) – Forecast +3.9%, versus +3.9% previous.

- German Consumer Price Index for Sep 2021 (MoM) (Prelim) – Forecast +0.1%, versus 0% previous.

- US Initial Jobless Claims – Forecast 335K, versus 351K previous.

- US Gross Domestic Product for Q2 2021 – Forecast 6.6% versus previous 6.6%.