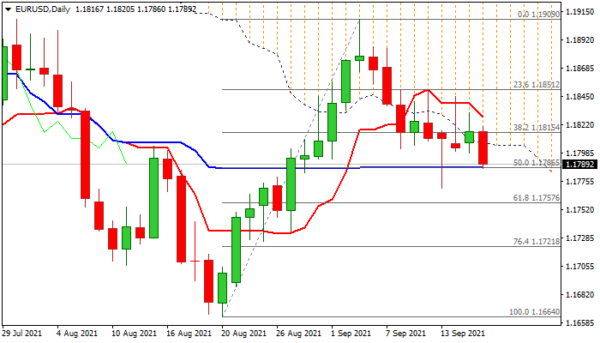

The Euro accelerates lower in early European trading on Thursday, signaling possible break of recent congestion, as long tails and upper shadows on daily candles in past few sessions pointed to indecision.

Near-term action remains bearishly aligned since recent bull-trap above 1.1894 Fibo barrier and weighed by falling thick daily cloud.

Fresh weakness looks for clear break of cracked daily Kijun-sen at 1.1786 (also 50% retracement of 1.1664/1.1909 upleg) to signal a continuation of pullback from 1.1909 (Sep 9 recovery peak).

South-heading 14-d momentum on daily chart is about to break into negative territory and add to bearish stance.

Acceleration through Kijun-sen pivot to expose targets at 1.1757/21 (Fibo 61.8% and 76.4% of 1.1664/1.1909 respectively) and risk full retracement on break of the latter.

Daily cloud base marks solid resistance at 1.1805, followed by broken Fibo 38.2% at 1.1815, with falling daily Tenkan-sen (1.1828) expected to cap upticks and keep bears in play. US retail sales and jobless claims data are key events today and eyed for fresh signals.

Res: 1.1805, 1.1815, 1.1828, 1.1845.

Sup: 1.1786, 1.1769, 1.1757, 1.1721.