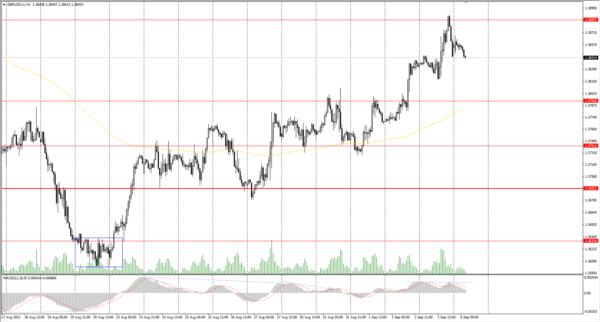

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1874

Prev Close: 1.1878

% chg. over the last day: +0.03%

Despite the decline in the dollar index, the EUR/USD currency pair remained at about the same level by the end of the day on Friday. The European currency is under pressure since some ECB officials began calling for a reduction in the QE program after last week’s poor inflation data. The ECB meeting on monetary policy will be held on Wednesday, so no strong growth in quotes should be expected before that time.

Trading recommendations

Support levels: 1.1854, 1.1816, 1.1799, 1.1759, 1.1704, 1.1620

Resistance levels: 1.1894, 1.1934, 1.1969

From a technical point of view, the general trend of the EUR/USD currency pair is bullish. The price broke through the priority change level and consolidated above. The MACD indicator is still signaling a divergence in the opposite direction. The price has deviated from the moving average; given the divergence, there is an increasing probability of a corrective downward movement. Under such market conditions, it is best to look for sell trades from the resistance levels, where sellers show initiative. Buy trades can be considered only after a pullback to the support levels near the moving average.

Alternative scenario: if the price breaks through the 1.1704 support level and fixes below, the mid-term uptrend will likely be broken.

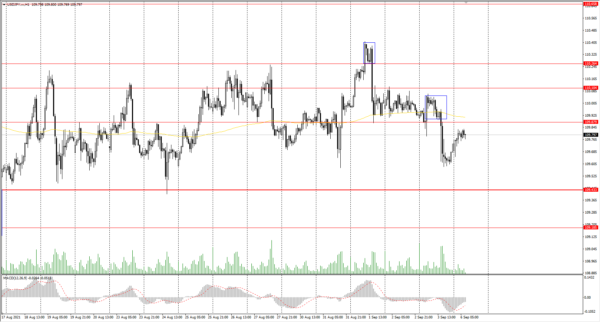

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3832

Prev Close: 1.3843

% chg. over the last day: +0.08%

The British pound is also getting stronger against the background of the dollar index decline. However, statistical data from the industrial and service sectors showed a slowdown in the recovery, which will have a negative impact on the national currency as well.

Trading recommendations

Support levels: 1.3793, 1.3741, 1.3692, 1.3632, 1.3614, 1.3525

Resistance levels: 1.3886, 1.3935, 1.4002

On the hourly time frame, the GBP/USD trend is bullish. The price broke through the priority change level on the impulsive movement and consolidated higher. The MACD indicator is in the positive zone, and there are the first signs of divergence on higher time frames. Under such market conditions, it is better to look for buy trades from the support levels after the price pullback as the price has now strongly deviated from the moving average. Sell positions can only be considered from the resistance levels with short targets throughout the day.

Alternative scenario: if the price breaks through the 1.3692 support level and consolidates below, the bearish scenario will likely resume.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 109.91

Prev Close: 109.68

% chg. over the last day: -0.21%

The USD/JPY currency pair is highly dependent on the dynamics of the dollar index now. The dollar index is declining, which leads to a decrease in the USD/JPY quotes. Japan will report GDP data for the last quarter this week and many economists are predicting stronger economic growth than it has been initially reported. On Friday, Japanese Prime Minister Yoshihide Suga announced that he will resign, setting the stage for a new prime minister afterward. This news not only strengthened the Japanese currency but also Japan’s main index, the Nikkei 225.

Trading recommendations

Support levels: 109.43, 109.19, 108.65

Resistance levels: 109.88, 110.11, 110.34, 110.66, 110.95, 111.48

The main trend of the USD/JPY currency pair is bullish. Now the price is trading in a wide corridor, but there are signs of sellers’ pressure. The MACD indicator has become negative. Under such market conditions, traders should look for buy trades from the support level, where buyers show initiative. Sell positions should be considered only on the lower time frames from the positions where sellers show initiative.

Alternative scenario: if the price falls below 109.43, the uptrend is likely to be broken.

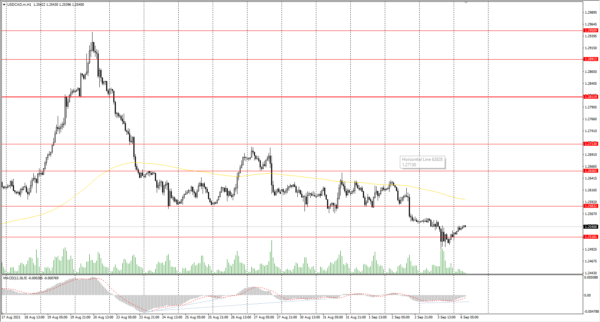

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2550

Prev Close: 1.2518

% chg. over the last day: -0.26%

The Canadian dollar is a commodity currency, so the USD/CAD currency pair is highly dependent on the dynamics of the dollar index and oil prices. The dollar index has been decreasing during the last week, while oil prices have been growing. As a result, the USD/CAD currency pair is now decreasing due to the strengthening of the Canadian dollar.

Trading recommendations

Support levels: 1.2518, 1.2425

Resistance levels: 1.2583, 1.2656, 1.2713, 1.2812, 1.2891, 1.2951

In terms of technical analysis, the trend on the USD/CAD currency pair has changed to bearish. The price broke through the priority change level on the impulsive movement and consolidated below. It is better to consider sell positions from the resistance levels, where sellers show initiative. Buy positions can be considered from the support levels after additional confirmation in the form of buyers’ initiative.

Alternative scenario: if the price breaks through the 1.2812 resistance level and fixes above, the uptrend will likely resume.