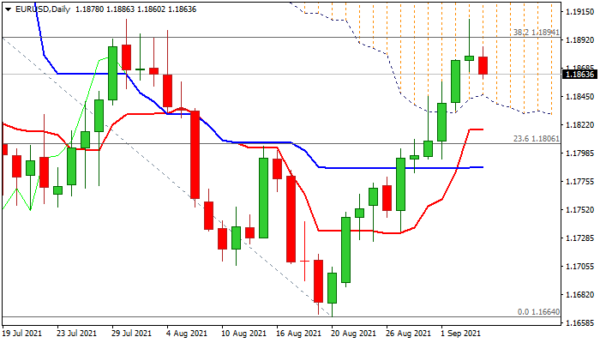

The Euro starts the week in negative mode and signaling correction after strong rally in past two weeks, as the dollar regained traction following a big US non-farm payrolls miss that fades Fed tapering expectations.

Last Friday’s Doji candle with long upper shadow generated an initial signal of rally’s stall, with rejection above Fibo 38.2% of 1.2266/1.1664 fall, warning of bull-trap pattern and adding to bearish signals.

Daily techs are mixed as positive momentum continues to rise and MA’s (5,10,20,30,55) are in bullish setup, but RSI turned south and stochastic is about to reverse from overbought territory. Traders look for cautious shorts with tight stops as fresh bears face strong supports at 1.1839 (daily cloud base) and 1.1815 (Fibo 38.2% of 1.1665/1.1909 upleg, reinforced by converging 10/55DMA’s).

Firm break of these supports is needed to weaken near-term structure and signal deeper correction, but dips might be limited as investors focus on ECB policy meeting later this week for more information about tapering expectations.

Res: 1.1894, 1.1909, 1.1950, 1.1975.

Sup: 1.1851, 1.1839, 1.1815, 1.1787.