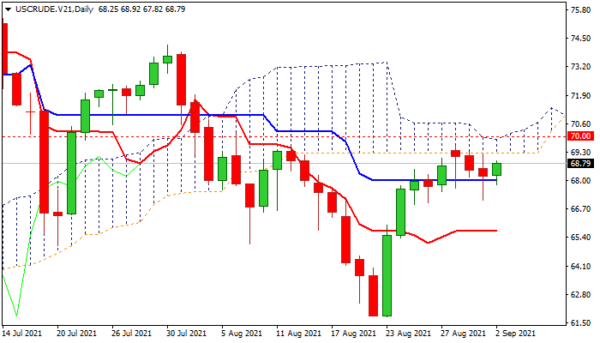

The WTI regained traction and edged higher on Thursday after three-day drop was contained by converged 10/20DMA’s which formed bull-cross.

Oil prices dropped on Wednesday after the OPEC+ group agreed to keep its policy of gradually phasing out record output reductions by adding by adding 400,000 barrels per day each month, but raised its demand forecast or 2022 that partially offset negative impact.

On the other side, US crude inventories fell by 7.2 million barrels and petroleum product supplies rose to a record despite the rise in new coronavirus cases that offered additional support to oil prices.

Bulls are on course for renewed attack at daily cloud base ($69.25) which capped the recent strong rally, with narrowing cloud which is going to twist next week, expected to be magnetic.

Sustained break of psychological $70 barrier (slightly above 50% retracement of $76.95/$61.82 pullback) would boost bulls and add to signals that corrective phase from new three-year high ($76.95) is over.

Caution on repeated rejections under $70 pivot, with return below 20DMA ($67.26) to sideline bulls.

Res: 64.00, 64.78, 65.12, 66.00.

Sup: 67.60, 67.26, 67.10, 66.62.