USD/JPY opened with a gap down and seems like that the sellers are very strong on the short term. Price hovers right above a very strong static support, only a valid breakdown will confirm a larger drop in the upcoming period.

The Yen increased significantly today as the Nikkei stock index has plunged. JP225 opened with a gap down today, signaling that the bears have taken full control. The index failed once again to stabilize above the 19700 static resistance, this situation could bring a broader drop in the upcoming period.

Technically, the Nikkei was expected to drop towards the 18936 level on the short term, this scenario is still on the table as long as is trading below the 19700 resistance.

The Yen received support also from the Monetary Base indicator, which was reported at 16.3%, higher versus the 15.6% estimate. You should know that the United States banks will be closed today in observance of the Labor Day.

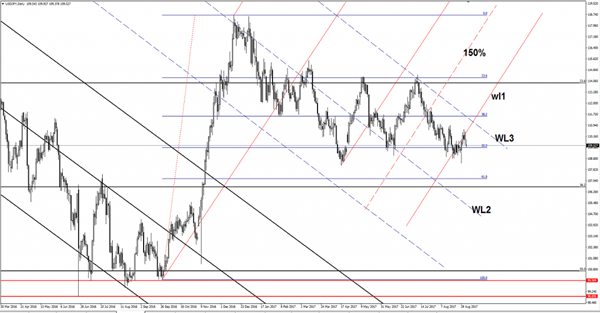

USD/JPY continues to move in range on the Daily chart, but looks too overbought to resume the minor rebound. Has found strong resistance right above the warning line (wl1) of the ascending pitchfork. A valid breakdown below the 50% retracement level will open the door for a significant drop.

The downside targets are at the 61.8% retracement level, at the long term 38.2% retracement level, could be attracted also by the warning line (WL2).