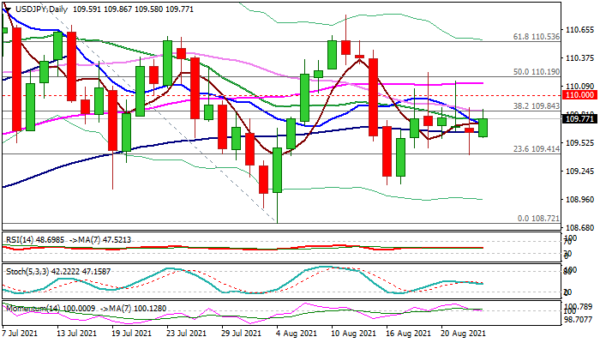

The USDJPY edged higher in European trading on Wednesday, just to return to the middle of the range that extends into six straight day.

Long shadows of daily candle of past few days signal strong indecision, as market awaits fresh signals from Jackson Hole symposium and a speech from Fed Chairman Powell later this week.

Near-term action continues to move between 100 and 55 DMA’s, with neutral daily studies lacking direction signals and keeping the pair in sideways mode.

Lift above psychological 110 barrier and 55DMA (110.12) would revive bulls for potential acceleration towards targets at 110.53 (Fibo 61.8% 111.65/108.72 descend) and 110.80 (Aug 11 peak).

Alternatively, firm break of 100DMA (109.63) and extension below Tuesday’s spike low (109.41) would bring bears in play.

Res: 109.88, 110.00, 110.12, 110.22.

Sup: 109.63, 109.41, 109.11, 108.87.