Key Highlights

- GBP/USD is struggling to climb above the 1.3900 resistance zone.

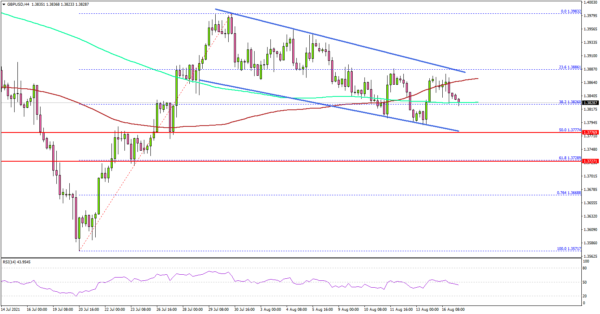

- A key declining channel is forming with resistance near 1.3885 on the 4-hours chart.

- EUR/USD failed to clear the main 1.1800 resistance zone.

- The UK ILO Unemployment rate could remain at 4.8% in June 2021 (3M).

GBP/USD Technical Analysis

The British Pound started a downside correction after it failed to surpass 1.4000 against the US Dollar. GBP/USD moved below the 1.3900 support, which is now acting as a resistance.

Looking at the 4-hours chart, the pair extended its decline below the 1.3850 support level and the 100 simple moving average (red, 4-hours). There was also a break below the 38.2% Fib retracement level of the upward move from the 1.3571 swing low to 1.3981 high.

However, the bulls are now protecting the 1.3780-1.3800 support zone. The 50% Fib retracement level of the upward move from the 1.3571 swing low to 1.3981 high is also near 1.3774.

If GBP/USD breaks the 1.3780-1.3800 support zone, there is a risk of a sharp decline. The next major support sits at 1.3725, below which the pair might revisit 1.3650.

On the upside, an initial resistance is near the 1.3880 level. There is also a key declining channel forming with resistance near 1.3885 on the same chart. A clear break above the channel resistance and 1.3900 might open the doors for a steady increase. The next key resistance could be 1.4000.

Looking at EUR/USD, the pair made an attempt to clear the 1.1800-1.1810 resistance zone, but it failed and it now remains at a risk of more downsides.

Economic Releases

- UK Claimant Count Change for July 2021 – Forecast -80.0K, versus -114.8K previous.

- UK ILO Unemployment Rate for June 2021 (3M) – Forecast 4.8%, versus 4.8% previous.

- Euro Zone GDP for Q2 2021 (Preliminary) (QoQ) – Forecast 2%, versus 2% previous.

- US Retail Sales for July 2021 (MoM) – Forecast -0.2%, versus +0.6% previous.