Key Highlights

- GBP/USD failed to clear 1.4000 and corrected lower.

- A key declining channel is forming with resistance near 1.3910 on the 4-hours chart.

- EUR/USD could decline heavily if there is a clear break below 1.1740.

- Gold price dropped sharply below the $1,750 support, crude oil price is also struggling below $70.00.

GBP/USD Technical Analysis

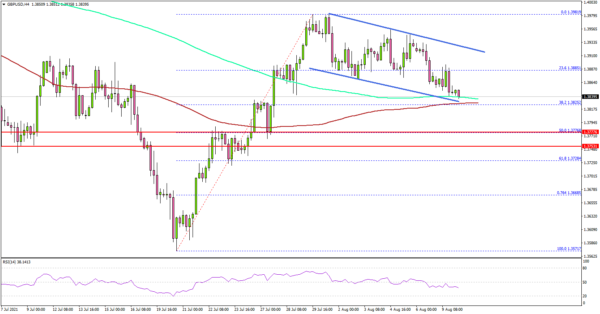

The British Pound attempted an upside break above 1.4000 against the US Dollar, but it failed. GBP/USD started a downside correction and it declined below the 1.3920 support zone.

Looking at the 4-hours chart, the pair also traded below the 1.3900 support. There was a break below the 23.6% Fib retracement level of the upward move from the 1.3571 swing low to 1.3981 high.

It seems like there is a key declining channel forming with resistance near 1.3910 on the same chart. If the pair climbs above the channel resistance, there could be a retest of 1.3980. The main resistance is still near the 1.4000 level.

A successful break above 1.4000 may possibly open the doors for a larger increase. On the downside, the first key support is near 1.3825, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The next major support is near the 1.3775 zone. It is close to the 50% Fib retracement level of the upward move from the 1.3571 swing low to 1.3981 high. Any more downsides might trigger a move towards 1.3620.

Looking at EUR/USD, the pair declined heavily below the 1.1850 support and it might struggle to recover in the near term. The main support on the downside is at 1.1740.

Economic Releases

- German ZEW Business Economic Sentiment Index for August 2021 – Forecast 57.0, versus 63.3 previous.