Technical analysis

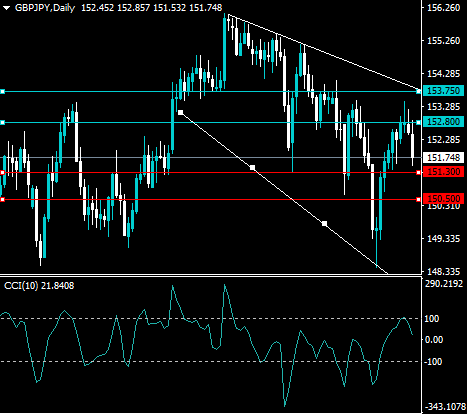

The daily time frame shows that the GPJPY pair has failed to break above the top a large descending broadening wedge pattern, which is increasing the chances of a downside correction.

The Commodity Channel Index indicator on the daily time frame highlights that the GBPJPY pair is also overbought around current trading level.

What the possible outcomes are

In our most likely scenario, the GBPJPY pair will fall towards the 150.50 area due to the fact that it is currently overbought and the Japanese yen is gaining strength amongst major currencies.

Alternatively, the GBPJPY pair may stage a modest price pullback towards the 151.40 level before rally to a new high, around the 153.00 level.

Key levels

Support 151.40 150.50

Resistance 152.20 153.00