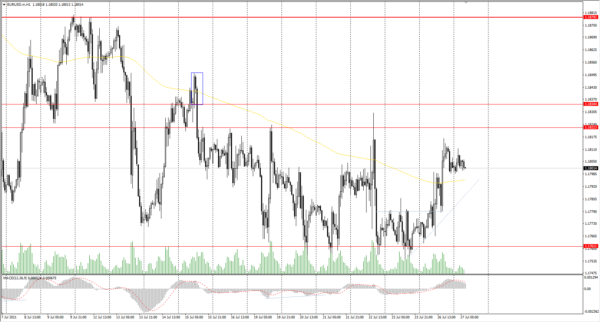

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1768

Prev Close: 1.1802

% chg. over the last day: +0.29%

Germany’s IFO Business Climate Index unexpectedly declined (from 101.7 to 100.8) in July, indicating the beginning of a slowdown in economic growth in the country. The reason for the slowdown is the threat of the Delta strain spreading, as well as the floods that hit the country in July. In addition, supply interruptions and higher inflation may also affect business optimism in the coming months.

Trading recommendations

Support levels: 1.1761, 1.1746, 1.1609

Resistance levels: 1.1822, 1.1834, 1.1879, 1.1934, 1.1969

From the technical point of view, the trend is still bearish. The price is trading within a wide 1.1761-1.1823 price range. The negative situation for the European currency remains unchanged, but short-term upward movements are not excluded. Under such market conditions, it is better for traders to look for sell positions from the resistance levels. Buy trades can be considered only on intraday time frames from the support levels.

Alternative scenario: if the price breaks through the 1.1879 resistance level and fixes above, the general uptrend is likely to be resumed.

News feed for 2021.07.27:

- US Core Durable Goods Orders (m/m) at 15:30 (GMT+3);

- US CB Consumer Confidence (m/m) at 17:00 (GMT+3).

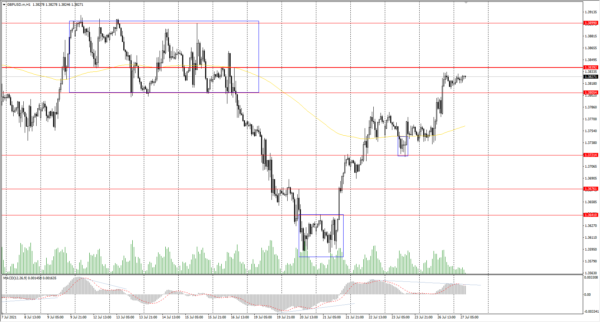

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3744

Prev Close: 1.3818

% chg. over the last day: +0.53%

The number of COVID-19 cases in the UK is declining, but the number of hospitalizations is increasing. The country’s recovery from the pandemic has not affected the business climate yet, but the British pound has been confidently growing for the last few days.

Trading recommendations

Support levels: 1.3805, 1.3721, 1.3676 ,1.3641, 1.3614, 1.3525

Resistance levels: 1.3899, 1.3923, 1.4002, 1.4075, 1.4101

The trend on the GBP/USD currency pair is downward on the H1 timeframe. But now, the price is ahead of the priority change level. The MACD indicator is in the positive zone but with signs of divergence. Under such market conditions, traders are better to look for sell trades from the priority change level. There are no optimal entry points for buy positions now.

Alternative scenario: if the price breaks through the 1.3839 resistance level and consolidates above, the bearish scenario is likely to be canceled.

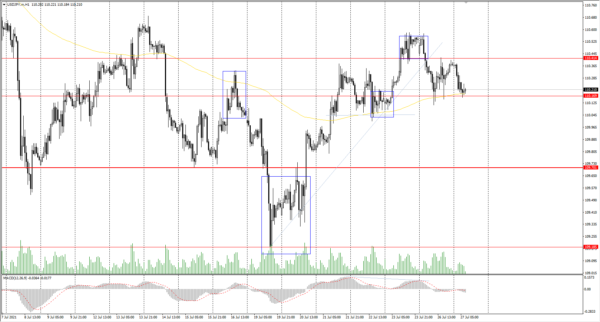

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 110.44

Prev Close: 110.38

% chg. over the last day: -0.05%

The situation on the USD/JPY currency pair remains the same. At the moment, the instrument is strongly correlated with the dollar index. Against the background of yesterday’s decline in the dollar index, USD/JPY also declined and is trading in a narrow price range now. The situation is unlikely to change before the speech of the Governor of the Bank of Japan.

Trading recommendations

Support levels: 110.17, 109.70, 109.19, 108.65

Resistance levels: 110.41, 110.73, 111.06, 111.48, 110.73, 112.18

In terms of technical analysis, the situation has become uncertain. On the one hand, the price broke through the priority change level on Friday. On the other hand, the price failed to consolidate higher and returned back under the level. Traders are better to consider intraday trading now. For buy positions, it’s better to wait for a pullback to the nearest support level. Sell positions should be considered only from resistance levels and with short targets.

Alternative scenario: if the price falls below 109.70, the downtrend is likely to be resumed.

News feed for 2021.07.27:

Japan BoJ Haruhiko Kuroda Speaks at 10:30 (GMT+3).

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2556

Prev Close: 1.2545

% chg. over the last day: -0.09 %

The situation with the USD/CAD currency pair has not changed. The Canadian dollar is a commodity currency and is highly dependent on oil price movements. Oil is now trading in the narrow price corridor, causing a consolidation on the USD/CAD currency pair.

Trading recommendations

Support levels: 1.2561, 1.2519, 1.2448, 1.2404, 1.2347, 1.2312

Resistance levels: 1.2671, 1.2787, 1,2951

Technically, the trend remains bullish. But the price is trading right at the priority change level. The MACD indicator is inactive. Traders are better to play it safe and take action only after the price moves to one side of the narrow price range.

Alternative scenario: if the price breaks through the 1.2561 support level and fixes below, the downtrend is likely to be resumed.