Key Highlights

- GBP/USD started an upside correction from the 1.3570 region.

- A key bearish trend line is in place with resistance near 1.3830 on the 4-hours chart.

- EUR/USD must clear 1.1820 and 1.1850 for a decent upward move.

- AUD/USD and NZD/USD are showing signs of a fresh recovery.

GBP/USD Technical Analysis

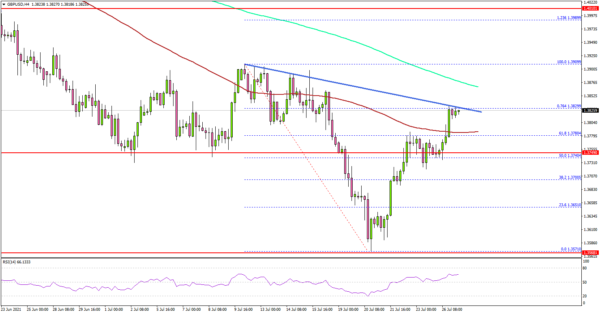

The British pound extended its decline below 1.3650 before it found support against the US Dollar. GBP/USD tested the 1.3570 zone and it recently started a steady recovery.

Looking at the 4-hours chart, the pair traded as low as 1.3571 and settled well below the 200 simple moving average (green, 4-hours). Recently, it started a strong recovery wave above the 1.3650 resistance.

There was a clear break above the 50% Fib retracement level of the key decline from the 1.3909 swing high to 1.3571 low. The pair even climbed above the 1.3800 level and the 100 simple moving average (red, 4-hours).

It tested the 76.4% Fib retracement level of the key decline from the 1.3909 swing high to 1.3571 low. There is also a key bearish trend line in place with resistance near 1.3830 on the same chart.

If GBP/USD settles above 1.3850 and the 200 simple moving average (green, 4-hours), it could accelerate higher. The next major resistance is near the 1.4000 level.

If not, there could be a fresh decline below the 1.3800 level. An initial support is near the 1.3780 level. The next major support is near the 1.3745 level.

Looking at EUR/USD, the pair could start a steady increase if there is a clear break above the 1.1820 and 1.1850 resistance levels.

Economic Releases

- US Durable Goods Orders for June 2021 – Forecast +2.1% versus +2.3% previous.

- US Durable Goods Orders ex Defense for June 2021 – Forecast +1.5% versus +1.7% previous.