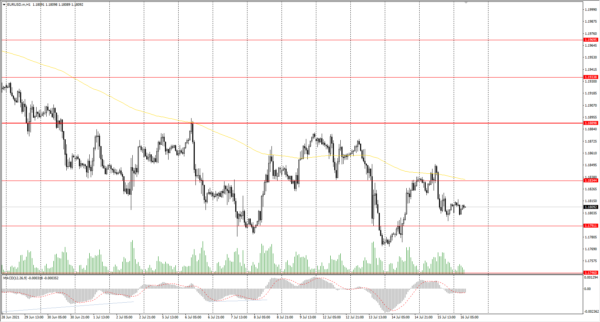

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1836

Prev Close: 1.1811

% chg. over the last day: -0.21%

Considering the good labor market data, the dollar index has slightly strengthened, which caused a slight decrease in the EUR/USD quotes (inverse correlation). Europe is reporting on inflation today. Economists are confident that the CPI number will not exceed the 2% target.

Trading recommendations

Support levels: 1.1791, 1.1746, 1.1609

Resistance levels: 1.1834, 1.1889, 1.1934, 1.1969

The trend is still bearish. The price did not manage to break through the dynamic level of the moving average. The MACD indicator is inactive. Under such market conditions, it is better to consider intraday trading. For sell positions, traders should wait for a pullback to the resistance level. Entries for long positions can be found on support levels but with short targets since this kind of trading will be against the trend.

Alternative scenario: if the price breaks through the 1.1889 resistance level and fixes above, the general uptrend is likely to be resumed.

News feed for 2021.07.16:

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+3);

- US Retail Sales (m/m) at 15:30 (GMT+3);

- US UoM Consumer Sentiment (m/m) at 17:00 (GMT+3).

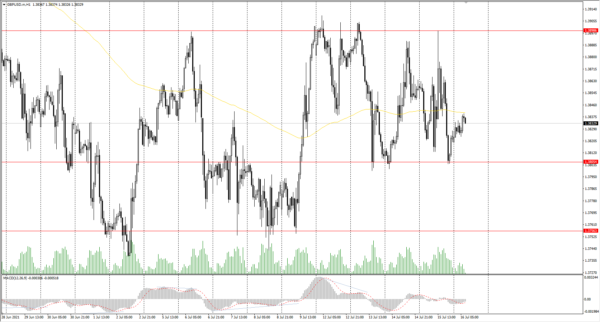

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3859

Prev Close: 1.3824

% chg. over the last day: -0.25%

The UK labor market is recovering. The number of jobs increased by 356,000. Annual wage growth increased from 5.7% to 7.3%, and the unemployment rate remained unchanged at 4.8%. The UK is getting ready to reopen the economy, and the British pound gained a stronger position than the euro.

Trading recommendations

Support levels: 1.3805, 1.3756

Resistance levels: 1.3899, 1.3923, 1.4002, 1.4075, 1.4101, 1.4138, 1.4191

The GBP/USD trend is bearish on the H1 timeframe. The price is trading in a wide range now. The MACD indicator has become inactive. Under such market conditions, it is better to consider intraday trading. For sell positions, traders should wait for a pullback to the resistance level. Entries for long positions can be found on support levels.

Alternative scenario: if the price breaks through the 1.3922 resistance level and consolidates above, the bearish scenario is likely to be canceled.

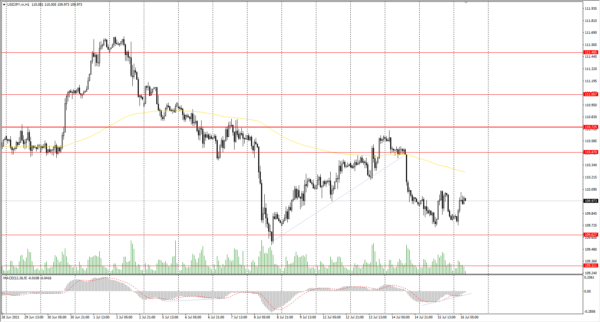

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 109.62

Prev Close: 109.83

% chg. over the last day: -0.08%

Japan’s central bank kept its key monetary policy easing measures unchanged and retained its inflation target at 2%. The bank also announced that it would provide zero percent loans to increase investment in green initiatives.

Trading recommendations

Support levels: 109.63, 109.31

Resistance levels: 110.47, 110.73, 111.06, 111.48, 110.73, 112.18

From the point of view of technical analysis, the situation has not changed. There is a downward trend on the H1 timeframe, as the price is still trading below the priority change level and below the moving average. The MACD indicator has become inactive. Under such market conditions, traders are better to look for sell positions from the resistance levels on intraday timeframes. Buy positions should be considered from support levels, but only with short targets.

Alternative scenario: if the price rises above 110.73, the uptrend is likely to be resumed.

News feed for 2021.07.16:

- BoJ Monetary Policy Statement at 06:00 (GMT+3);

- BoJ Outlook Report at 06:00 (GMT+3);

- BoJ Press Conference at 06:00 (GMT+3).

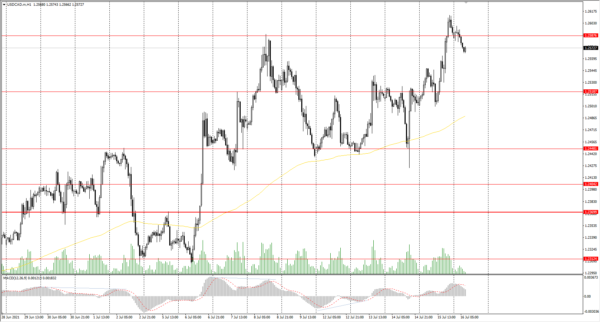

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2502

Prev Close: 1.2592

% chg. over the last day: +0.72%

The USD/CAD currency pair increased by 0.72% yesterday. The growth was caused by two factors: the growth of the dollar index and the decline in oil prices. The Canadian dollar is a commodity currency, so a decline in oil prices has a negative impact on the CAD.

Trading recommendations

Support levels: 1.2519, 1.2448, 1.2404, 1.2347, 1.2312, 1.2260, 1.2190

Resistance levels: 1.2587

Technically, the trend remains bullish. The price is still trading above the moving average and above the priority change level. The MACD indicator is in the positive zone with no signs of reversal. Under such market conditions, it is best to look for buy trades from the support levels. There are no optimal entry points to open sell positions now.

Alternative scenario: if the price breaks through the 1.2370 support level and fixes below, the downtrend is likely to be resumed.