Key Highlights

- USD/JPY started a major decline below the 111.00 and 110.00 levels.

- It traded below a crucial bullish trend line with support at 110.35 on the 4-hours chart.

- EUR/USD and GBP/USD recovery could face resistance near 1.1900 and 1.3850 respectively.

- Crude oil price is stable above the $70.00 support zone.

USD/JPY Technical Analysis

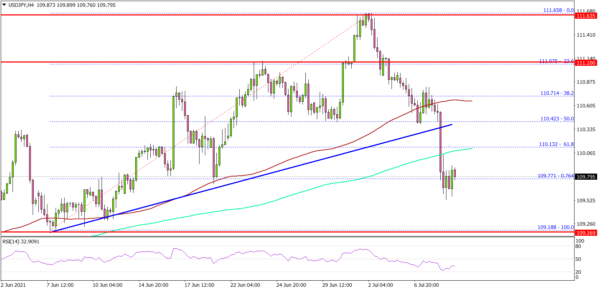

The US Dollar topped near the 111.65 level against the Japanese Yen. USD/JPY started a major decline, and it traded below the 111.00 and 110.50 support levels.

Looking at the 4-hours chart, the pair gained bearish momentum below the 111.00 level. There was also a break below a crucial bullish trend line with support at 110.35.

The pair even traded below the 50% Fib retracement level of the upward move from the 109.18 swing low to 111.65 high. It is now trading well below 110.20 and the 100 simple moving average (red, 4-hours).

There was also a spike below the 76.4% Fib retracement level of the upward move from the 109.18 swing low to 111.65 high. It seems like USD/JPY might continue to move down towards the 110.20 support level.

The next major support is near the 110.00 level. Any more losses may possibly call for a drop towards the 109.40 level.

Looking at EUR/USD, the pair is attempting a recovery, but it could face resistance near 1.1900. Similarly, GBP/USD is likely to struggle near 1.3850 and 1.3900.

Economic Releases

- UK Industrial Production for May 2021 (MoM) – Forecast +1.5%, versus -1.3% previous.

- UK Manufacturing Production for May 2021 (MoM) – Forecast +1.0%, versus -0.3% previous.

- UK GDP for May 2021 (MoM) – Forecast +1.7%, versus +2.3% previous.

- Canada’s Employment Change for June 2021 – Forecast 195K, versus -68K previous.

- Canada’s Unemployment Rate for June 2021 – Forecast 7.7%, versus 8.2% previous.