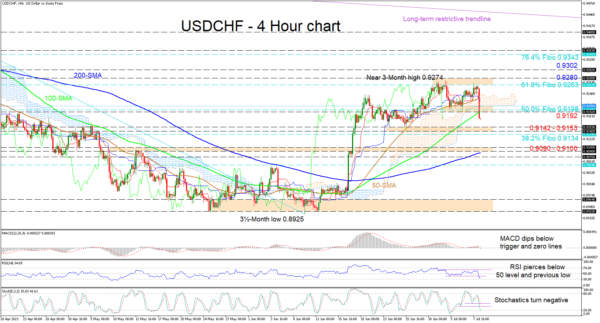

USDCHF has been struggling to decisively extend past the 61.8% Fibonacci retracement of the down leg from 0.9472 until 0.8925, only ticking to a near 3-month peak of 0.9274. In spite of the climbing simple moving averages (SMAs) defending the recent price improvements, negative pressures have managed to steer the price beneath the support section between the Ichimoku cloud’s floor and the 100-period SMA at 0.9192.

The Ichimoku lines are tilting lower, while the short-term oscillators are reflecting the surge in selling interest, which started in the proximity of the 61.8% Fibo. The MACD has nudged beneath its red trigger line and a tad below the zero threshold, while the RSI is growing increasingly negative. The negatively charged stochastic oscillator is also presently promoting downward tendencies.

As things stand with the bears breaking the important 0.9192-0.9208 support section, the pair looks set to snowball. That said, downside limitations around the 0.9142-0.9153 region, along with the 38.2% Fibo of 0.9134 lingering beneath, could barricade additional declines in the pair. However, should the price deteriorate further, the 0.9090-0.9100 boundary could then come into play.

If the 0.9142-0.9153 support base helps the pair gather its feet, initial resistance could emanate from the 0.9192-0.9208 zone. Improvements in the pair may then falter around the 50-period SMA, otherwise, a push above the cloud may encourage buyers to challenge the minor ceiling formed between the 61.8% Fibo and the April 9 high of 0.9280. Gaining confidence, buyers may then examine the 0.9302 barrier before piloting for the 76.4% Fibo of 0.9343.

Summarizing, negative pressures appear to be dictating the short-term price direction. However, for USDCHF to retain a positive spark, the price would need to endure above the 0.9153 lows from the end of June.