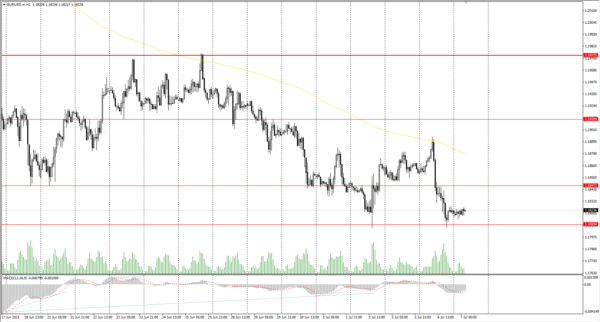

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1859

Prev Close: 1.1823

% chg. over the last day: -0.30%

The dollar index increased sharply yesterday, triggering a decline of the major currency pairs against the dollar. Despite positive data from Europe, the EUR/USD currency pair decreased by 0.3%, falling back to the 1.1809 support level.

Trading recommendations

Support levels: 1.1809

Resistance levels: 1.1847, 1.1911, 1.1973, 1.2002, 1.2050, 1.2109, 1.2144, 1.2174, 1.2212

The trend is still bearish. The price returned to the 1.1809 support level, forming a double-bottom pattern. But the initiative from the buyers is very weak. The MACD indicator is in the negative zone, and there are signs of divergence on the higher timeframes. Under such market conditions, it is better to trade intraday and look for buy trades from the support levels now. There is no good entry point for short positions at the moment.

Alternative scenario: if the price breaks out through the 1.1972 resistance level and fixes above, the general uptrend is likely to be resumed.

News feed for 2021.07.07:

- Europe Economic Forecasts (q/q) at 12:00 (GMT+3);

- US JOLTs Job Openings (m/m) at 17:00 (GMT+3);

- US FOMC Meeting Minutes at 21:00 (GMT+3).

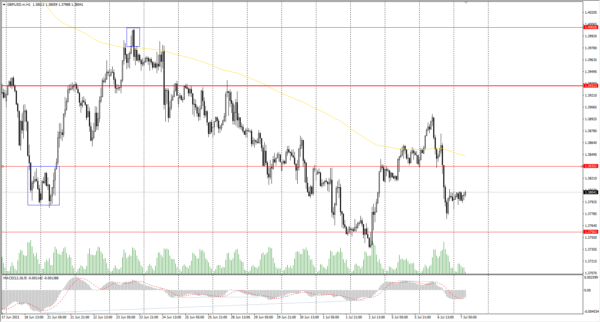

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3835

Prev Close: 1.3794

% chg. over the last day: -0.30%

The United Kingdom is a supplier of Brent crude oil and is ranked 13th among oil-producing countries. Yesterday’s sharp drop in oil prices and strengthening of the dollar index caused the fall of GBP/USD quotes. Today’s FOMC minutes will be crucial in terms of understanding where the British pound will go next.

Trading recommendations

Support levels: 1.3756

Resistance levels: 1.3835, 1.3923, 1.4002, 1.4075, 1.4101, 1.4138, 1.4191

The GBP/USD trend is bearish on the H1 timeframe. Buying pressure has become weak now; the price drops below the moving average. The MACD indicator is in the negative zone, but there are signs of divergence. Under such market conditions, traders are better to look for both sell trades from the resistance levels and buy trades from the support levels on the intraday timeframes.

Alternative scenario: if the price breaks out through the 1.3922 resistance level and consolidates above, the bearish scenario is likely to be canceled.

News feed for 2021.07.07:

- US FOMC Meeting Minutes at 21:00 (GMT+3).

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 110.93

Prev Close: 110.61

% chg. over the last day: -0.29%

The futures on the Japanese yen, which has an inverse correlation with the USD/JPY currency pair, sharply increased yesterday. The most interesting thing is that the rise in the dollar index did not stop the fall of USD/JPY, which means that the Japanese yen is now strengthening more than the US dollar.

Trading recommendations

Support levels: 110.47, 109.83, 109.62, 109.31

Resistance levels: 110.73, 111.06, 111.48, 110.73, 112.18

From the point of view of technical analysis, the trend remains bullish. But the price reached the change priority level yesterday and tried to break down through it, but the buyers managed to defend their positions. Taking into account the divergence on the MACD indicator, traders are better to look for buy deals from the support levels. For confident selling, it is better to wait for a breakdown of 110.47 support level.

Alternative scenario: if the price falls below 110.47, the general downtrend is likely to be resumed.

News feed for 2021.07.07:

- US FOMC Meeting Minutes at 21:00 (GMT+3).

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2337

Prev Close: 1.2456

% chg. over the last day: +0.96%

The USD/CAD currency pair increased by 0.96% by the end of the day. The USD/CAD quotes are highly dependent on two factors now: the dollar index and oil prices. Yesterday, the dollar index sharply increased while oil prices collapsed, which provoked a rapid jump of USD/CAD quotes.

Trading recommendations

Support levels: 1.2404, 1.2347, 1.2312, 1.2260, 1.2190

Resistance levels: 1.2478, 1.2519

Technically, the trend remains bullish. The price is trading above the moving average, but there is a strong deviation from the midline. The MACD indicator has returned to the positive zone with no signs of divergence. Under such market conditions, it is best to trade on the lower timeframes. Buyers need to wait for a slight pullback to the nearest support levels. Traders can also look for entry points on intraday timeframes for short positions, but only with short targets because it will be trading against the trend.

Alternative scenario: if the price breaks down through the 1.2260 support level and fixes below, the downtrend is likely to be resumed.

News feed for 2021.07.07:

- Canada Ivey PMI (m/m) at 17:00 (GMT+3);

- US FOMC Meeting Minutes at 21:00 (GMT+3).