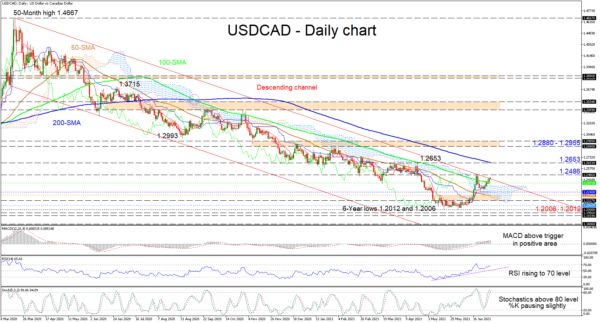

USDCAD is labouring to break above and out of a descending channel, whose grasp on the pair has endured past a full year. The commanding simple moving averages (SMAs) are still shaping a predominantly bearish picture, making even more challenging the task for buyers to gain a clear upper hand.

The bulls are currently lacking the necessary upward drive to pierce above the channel’s upper band and overstep the nearby 1.2486 fresh high, something also being reflected in the Ichimoku lines. As things stand, the short-term oscillators are conveying conflicting signals in directional momentum. The MACD is holding above its red trigger line in the positive region, while the gradually rising RSI remains aimed at the 70 level. That said, the stochastic %K line is stalling in overbought territory, indicating the absence of positive impetus needed to conquer the upper boundary of the channel.

At this point, buyers need to gather significant positive forces to pilot past the immediate ceiling of the channel and the neighbouring high of 1.2486, for upside momentum to gain some pace. Successfully doing so could propel the pair to challenge the resistance barrier at 1.2653, where the 200-day SMA also presently resides. Defeating the 200-day SMA could fuel buyers with confidence to navigate towards the 1.2880-1.2955 resistance section.

If the channel remains victorious in dismissing advances, an early support zone could develop from the 100-day SMA at 1.2373 until the blue Kijun-sen line at 1.2243. Should the recoil off the ceiling of the channel continue lower, next in line is an adjacent support band from the 50-day SMA at 1.2200 until the 1.2127 low. Becoming increasingly heavy again, the pair may target the 1.2060 level, being the September 2017 trough, and the 6-year lows of 1.2012 and 1.2006 respectively.

Summarizing, USDCAD’s bullish efforts could find aid from the cluster of support obstacles beneath and especially if the greenback receives a booster-jab from stronger NFP payrolls report, later in the day. Yet, should the data disappoint and bearish pressures endure, the descending channel could soon regain its dominance over the pair.