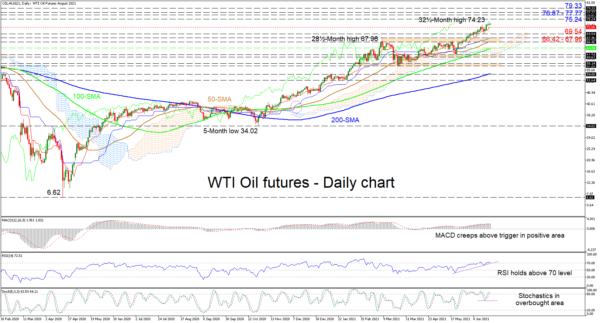

WTI oil futures’ positive drive has somewhat lost its potency, after logging a 32½-month high of 74.23 despite prevailing bullish forces. The climbing simple moving averages (SMAs) are safeguarding the uptrend, while the rising Ichimoku lines are endorsing additional price gains.

The short-term oscillators are reflecting a slight pause in positive directional momentum. The MACD has sneaked ever so slightly above its red trigger line, while the RSI is persisting above the 70 level. The stochastic oscillator is currently in overbought territory and the %K line has yet to confirm any rise in negative momentum.

If the commodity continues to appreciate, resistance may originate from the 75.24 high, identified in October 2018. Successfully overstepping this barrier, a tough resistance zone formed between the peak of 76.87, from early October 2018, and the 77.77 high, achieved late in September 2014, could impede buyers from challenging the 79.33 border lingering overhead.

If sellers resurface, initial support could occur at the red Tenkan-sen line at 72.06 ahead of the 69.54 low. Another leg lower could then encounter a buffer zone from 67.96 until 66.42, which also encompasses the blue Kijun-sen line and the 50-day SMA. If bearish pressures intensify, the Ichimoku cloud and the 100-day SMA at 64.08 could come to the defence of the recent rally off the 61.54 trough.

Concluding, WTI futures continue to maintain a sturdy bullish demeanour above 66.42-67.96 and the SMAs. A downwards shift past the 61.54 trough could suggest sellers are gaining a strong advantage.